Varun Resh

Fintech & Emerging Technologies

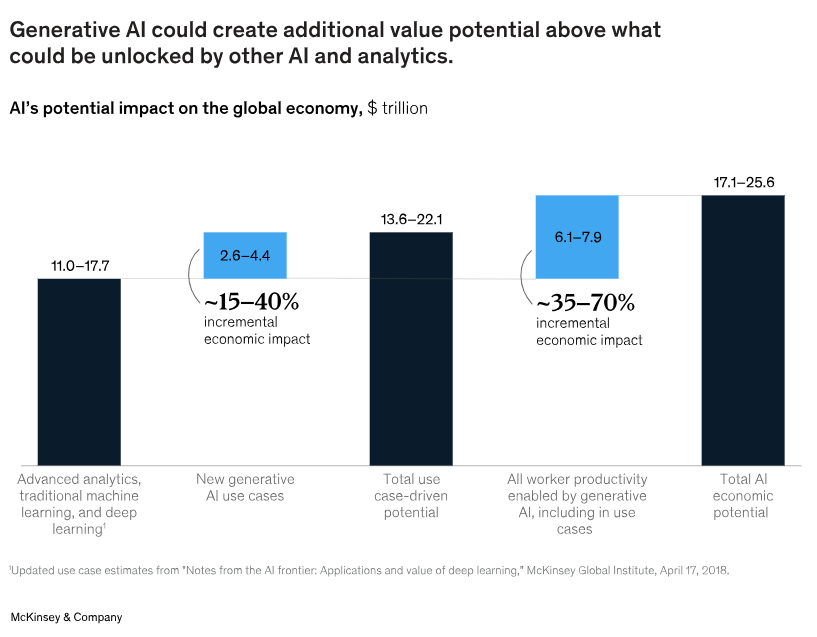

Generative AI's Emergence and Potential

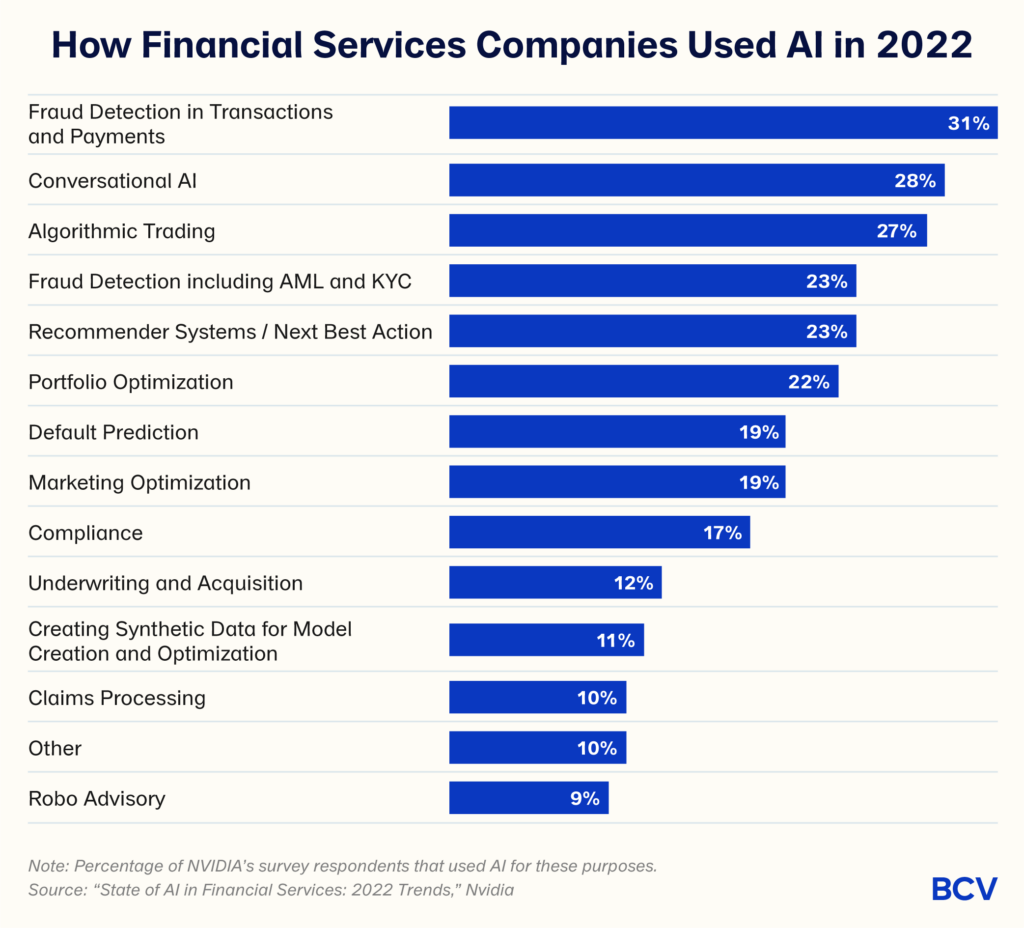

Product innovation and usecases:

How Can Financial Institutions Leverage AI by Partnering with fintechs?

Governance: Accessing AI including LLM’s and apps is controlled and auditable through the off-estate Sandbox Environment.

Security Constraint: Third-party off estate environments enable secure and controlled access to technology that is restricted within the bank’s environment.

Data Sharing: With NayaOne you can leverage statistically accurate synthetic datasets to evaluate AI without leaking sensitive information.

Accuracy & Validity: Opportunity and access to multi-vendor comparisons using the same dataset to compare the output without leaking sensitive data, onboarding the vendor or accessing it via the bank.

Fit to business need: Banks can validate multiple vendors off estate against the same KPI’s as well as deploy and train LLM’s within an air gapped environment.

Scalability: Scalability and stress testing of the application can be evaluated iteratively off estate by increasing the data input. Use Case scalability can be evaluated through repeated experiments varying the data type and theme of questioning.