Deliver, Test and Prove New Technology in a Digital Sandbox

One secure environment to bring data, vendors and teams together so you can validate solutions before you commit to onboarding.

Why Traditional Testing Slows Innovation - and How a Digital Sandbox Speeds It Up

Traditional testing environments are slow, rigid, and resource-heavy - making it difficult for teams to experiment, validate ideas, or onboard new technologies quickly. A digital sandbox removes these barriers by providing safe data, instant integrations, and a controlled space to build and test at speed.

01

Complex Systems Create Delivery Bottlenecks

Legacy infrastructure, multiple environments, and rigid release processes force teams into long setup cycles. More time is spent preparing to test than actually testing.

02

Data Access Is Slow and Highly Controlled

Gaining approval for real or sensitive data can take weeks or months. Without safe, ready-to-use datasets, teams can’t experiment freely or validate ideas early.

03

Vendor Testing Takes Too Long to Start

Every new fintech or technology partner requires its own integration, procurement checks, and security reviews. These steps turn fast innovation into a lengthy, resource-heavy process.

04

No Safe Space for Rapid Experimentation

Teams are constrained by production-like environments that limit what they can try. Without a secure, off-premise sandbox, experiments are risky, expensive, and often deprioritised.

What is a Digital Sandbox?

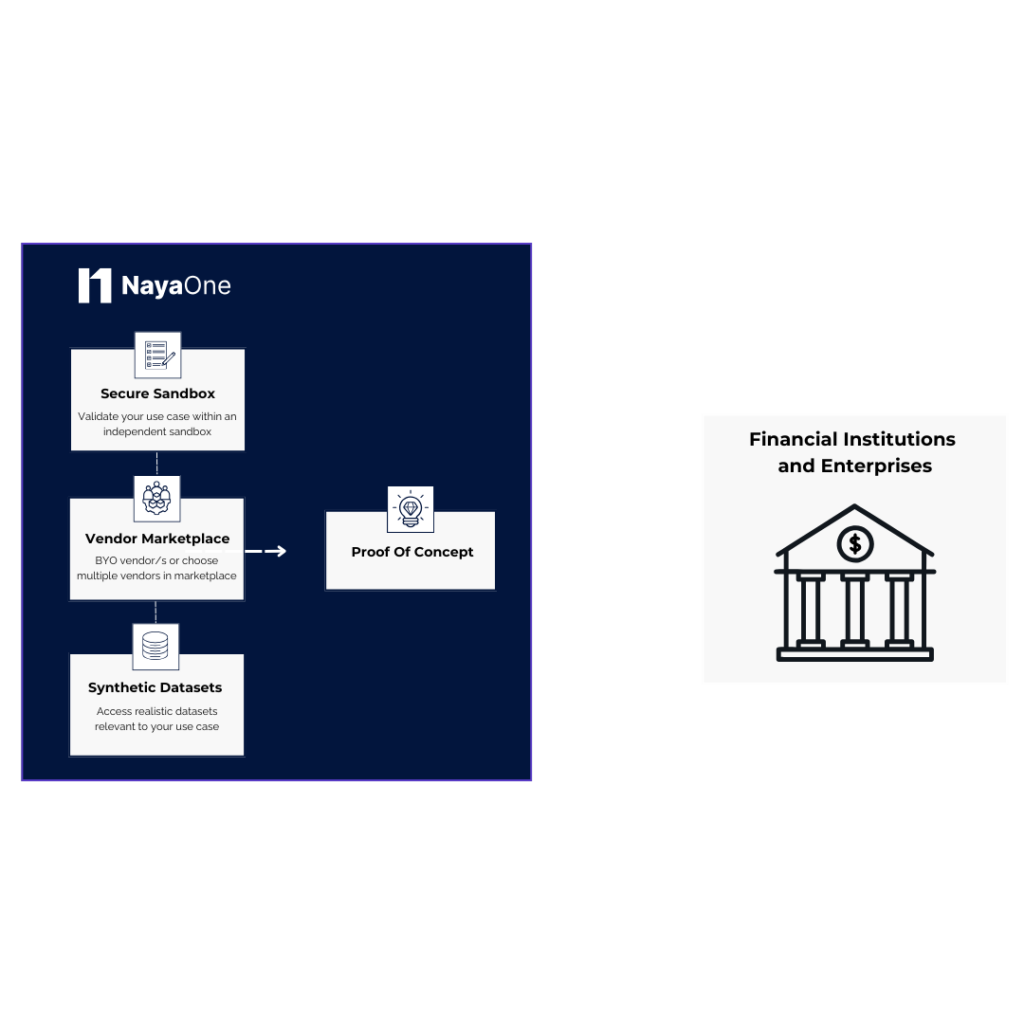

A digital sandbox is a secure, controlled environment that allows teams to test, validate, and iterate on new ideas without impacting production systems. It eliminates the delays of traditional testing by providing instant access to data, tools, and integration-ready technologies. With NayaOne, these advantages come together through three essential capabilities that enable rapid prototyping, vendor validation, and technology exploration - all within a safe, isolated environment designed for enterprise innovation.

Secure Workspaces

Experiment confidently with no risk to live systems.

Pre-Integrated Tools & APIs

Test fintechs, AI tools, and new tech partners in one seamless space.

Synthetic Data Libraries

Work with synthetic datasets designed for experimentation.

Used Across Enterprise Innovation and AI Delivery

Enterprises use NayaOne to evaluate vendors, prove capabilities, and move new technology into delivery with confidence.

These are recent use cases teams ran on the NayaOne platform.

AI Model Evaluation

Teams assess model accuracy, performance, and reliability in controlled environments before enterprise rollout.

Claims/Fraud Automation

Teams test automation tools against real decision flows to confirm detection accuracy, false positive rates, and workflow fit.

Customer Experience

NayaOne accelerates CX PoC, helping insurers launch satisfaction-boosting tools sooner.

Digital Assets and Tokenisation

Teams explore digital asset use cases and custody models, confirming operational readiness and regulatory alignment before scaling.

Digital Identity and Onboarding

Teams validate ID, verification, and KYC solutions to ensure they meet compliance requirements and integrate cleanly with onboarding journeys.

Lending and Credit Decisioning

Teams test credit models, scoring tools, and onboarding workflows to confirm accuracy, fairness, and operational fit before roll-out.

Payments Modernisation

Teams evaluate new payment solutions for speed, interoperability, and operational resilience before introducing them into core systems.

Regulatory Sandbox

and Supervisory Tech

Regulators run controlled experiments to understand emerging solutions, assess risk, and guide policy direction.

SMB Banking

and Product Evaluation

Teams evaluate SMB-focused platforms, onboarding journeys, and servicing tools to ensure they work end-to-end for business customers before adoption.

Accelerate How You Discover and Test Third-Party Technology

Trusted by Leading Financial Institutions and Large Enterprises

positioning us well ahead in the digital transformation and AI race.

giving enterprises a clear path to innovate and deliver ROI faster.

Shout out also to our partners Amazon Web Services (AWS) and NayaOne.

who drive responsible innovation at Valley.

FAQs

Common use cases include vendor evaluation, PoC testing, API integration, risk modelling, regulatory exercises, product prototyping, and exploring new technologies like AI or open finance.

The Digital Sandbox uses two core pieces of NayaOne infrastructure:

the Enterprise Gateway and the Synthetic Data Library.

- Enterprise Gateway: This is where vendor APIs and solutions are available. The sandbox pulls these into your workspace so you can test and compare them without doing any integrations.

- Synthetic Data Library: The sandbox comes preloaded with realistic, high-quality synthetic data for common banking and insurance journeys. No personal data is used.

Together, they let you test vendors, build prototypes and run end-to-end journeys quickly in an air-gapped, off-premise environment.

In-house sandboxes often come with long setup times, limited data availability, and heavy reliance on internal engineering resources. Teams struggle with slow access to compliant data, inconsistent environments across business units, and bottlenecks caused by shared infrastructure. Integrations take longer, environments become hard to maintain, and overlapping sandboxes lead to duplicated effort and rising operational costs. As a result, innovation slows down, vendor evaluations stall, and teams find it difficult to experiment freely without risking disruption to production systems.

Different teams across an enterprise often rely on their own dedicated sandbox environments, each designed for a specific purpose – whether regulatory compliance, development and testing, integration work, risk assessment, cloud experimentation, or customer-focused innovation.

Each team operates with unique priorities and requirements, so their sandboxes are tailored to meet those specialised needs.

It’s also important to recognise that these environments typically function independently, with controls, limitations, and configurations aligned to their intended use case.

No, NayaOne is cloud-and technology-agnostic, allowing you to test a wide range of solutions without the usual limitations or restrictions.

By operating outside your network and systems, NayaOne provides a secure, isolated environment that minimises data and security risks during testing.

NayaOne offers a diverse range of synthetic data sets designed to mimic real-world scenarios without using sensitive information. These include personal identification data such as synthetic passports, IDs, and driver’s licenses, as well as financial records like bank statements, tax and accounting documents, and credit reports. This allows users to test systems and evaluate solutions in realistic environments while ensuring data privacy and compliance. Find out more about synthetic data.

Yes, absolutely. NayaOne provides the flexibility to onboard them into our sandbox environment. This allows you to evaluate their solutions using our platform’s tools, including synthetic data and risk-free testing capabilities, without the delays of traditional onboarding processes. Alternatively, you are able to use our vendor marketplace to find the right vendor for your use case.