Launch Products

Test Vendors

Go to Market

10x Faster

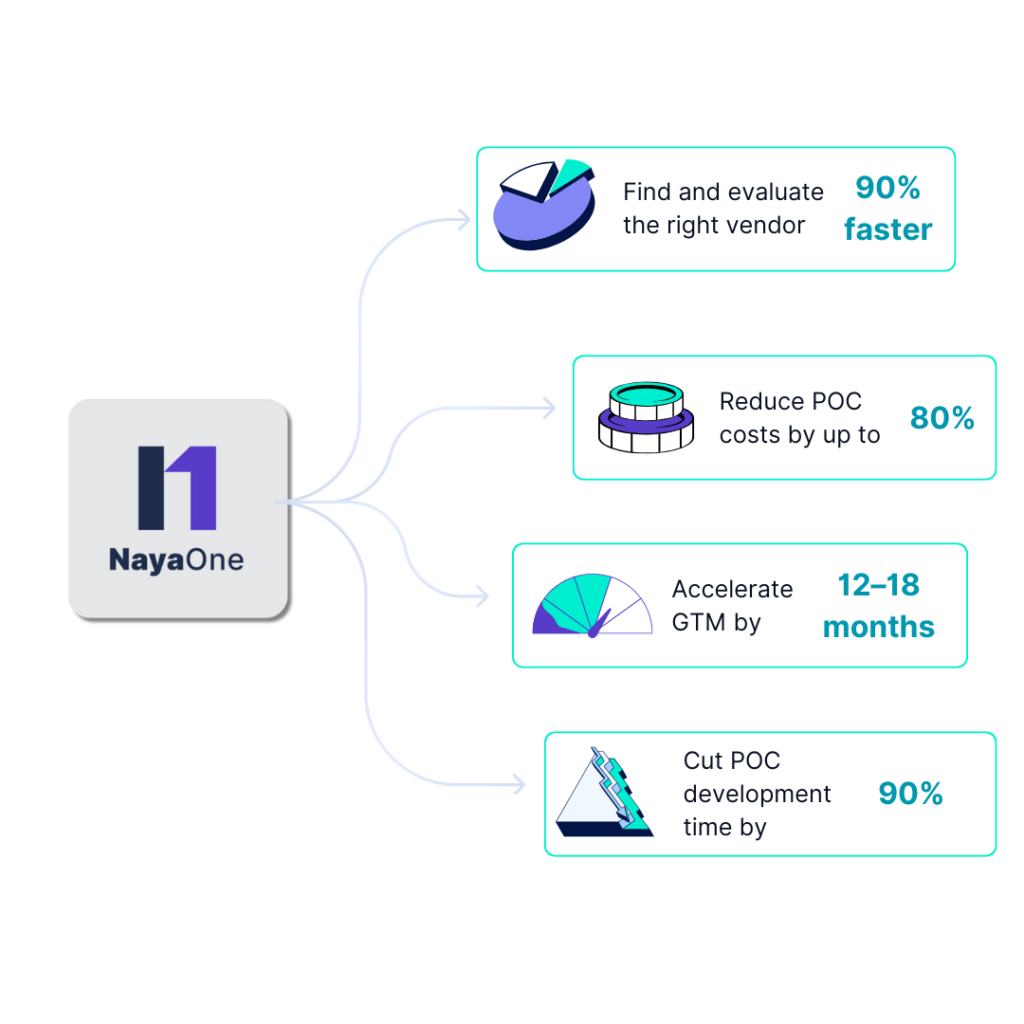

A single platform for seamless POCs, third-party tech evaluation, and synthetic data access.

NayaOne helps enterprises quickly test and adopt new solutions, speeding up time to market and keeping them competitive with faster, better services for their customers.

Rapidly build and test new POCs

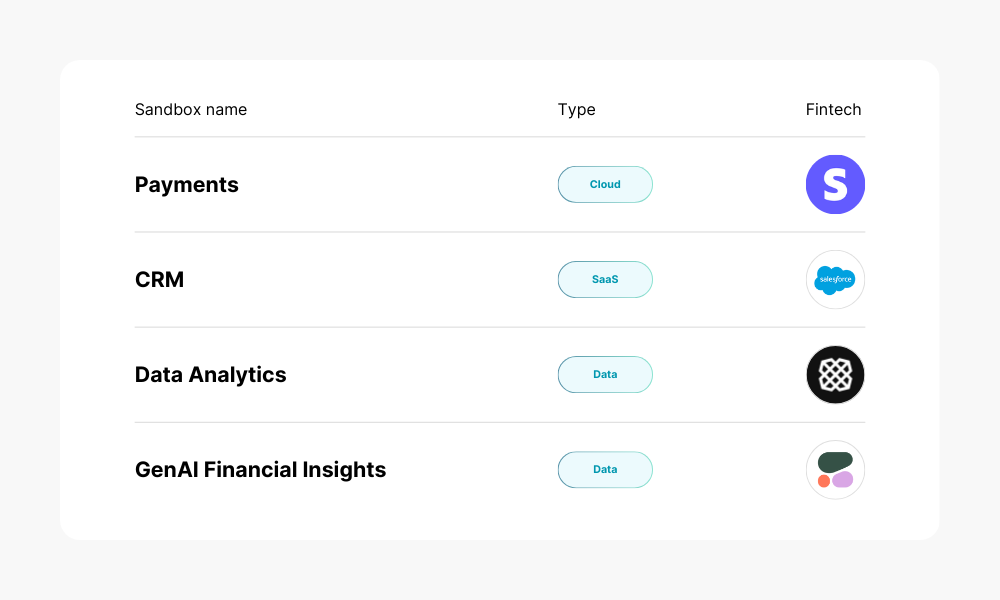

NayaOne's Digital Sandbox offers a secure, controlled space for Enterprises to explore new ideas and collaborate with fintechs. Using synthetic data and ready-to-use APIs, teams can quickly test and refine prototypes, speeding up the development of new financial products.

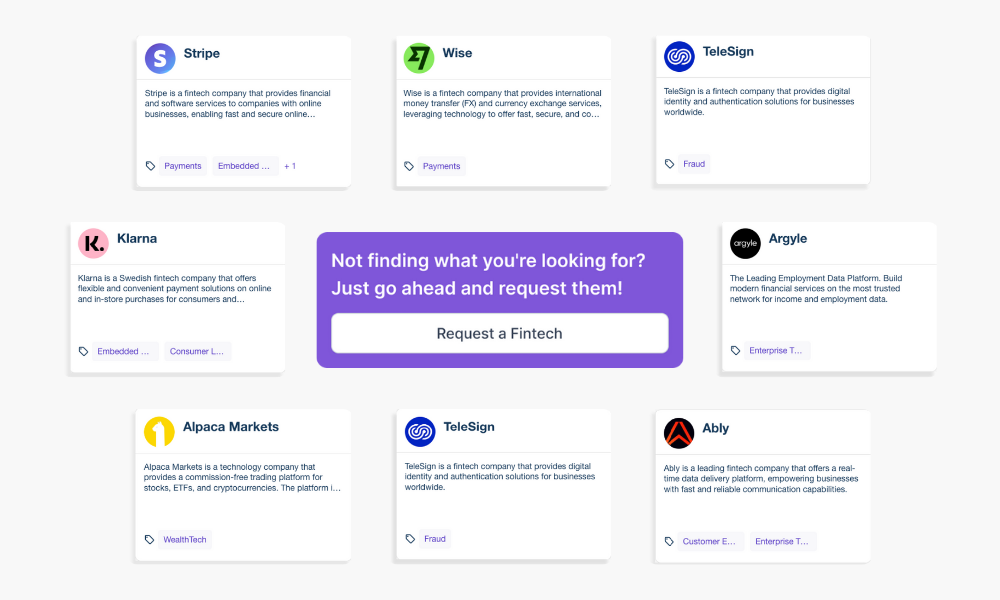

Quickly discover and engage fintech vendors

NayaOne's Marketplace connects Enterprises with vetted fintech vendors, simplifying the process of finding, testing, and deploying new technologies. Access a wide range of solutions tailored to your needs and bring innovations to market faster.

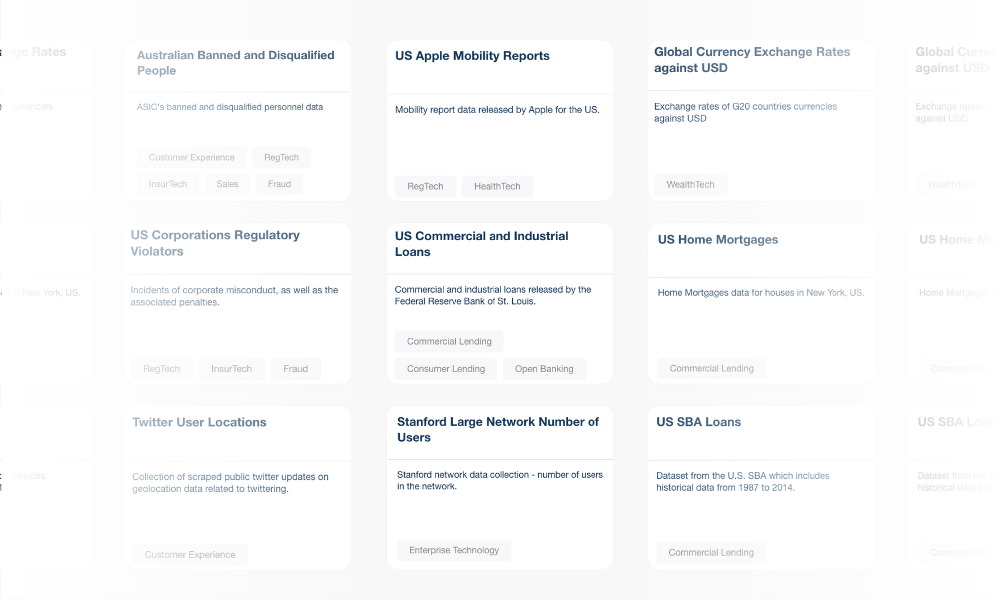

Accelerate development with safe, high-quality synthetic data

Synthetic data is a safe stand-in for real data, letting teams develop and test software, applications, and machine learning models without risking sensitive information. It’s quick to create, helping speed up development and get products to market faster. Plus, synthetic data can be tailored to improve model accuracy, leading to better results and predictions.

Use cases

Proof of concepts

Proof of concepts

Regulatory compliance

Regulatory compliance

Customer experience

Customer experience

Payments

Payments

Risk management

Risk management

Fraud detection

Fraud detection

How Enterprise teams use NayaOne

- Strategically explore fintech partnerships aligned with long-term enterprise goals.

- Monitor emerging trends and technologies to stay ahead of competitors.

- Foster a culture of innovation through cross-functional collaboration.

- Equip teams with advanced Generative AI knowledge for improved decision-making and efficiency.

- Leverage cutting-edge technology to drive innovation and support strategic growth.

- Rapidly prototype and test innovative ideas in a secure environment, accelerating experimentation without regulatory risk.

- Access diverse fintech solutions and synthetic datasets to develop, test, and refine concepts in line with strategic innovation objectives.

- Streamline collaboration between internal teams and external partners for quicker decision-making and faster deployment of new solutions.

- Test new technologies and solutions in a controlled environment, ensuring compliance with regulatory requirements before full deployment.

- Access synthetic datasets to safely simulate and analyse risk scenarios without exposing sensitive customer data.

- Accelerate product development by prototyping and testing ideas in a secure, compliant environment.

- Leverage a variety of fintech solutions and synthetic datasets to refine and perfect products aligned with your innovation strategy.

- Facilitate seamless collaboration between product teams and external partners to speed up development cycles and bring solutions to market faster.

FAQs

Sandbox as a Service (SaaS) refers to a cloud-based environment where developers and teams can safely test and experiment with applications, software, or data without impacting their live systems. Within a sandbox, users can establish isolated spaces to run their projects, enabling them to explore new ideas, conduct experiments, or perform quality assurance checks.

NayaOne can help your business evaluation and proof of concept by providing synthetic data that mimics real-world scenarios while keeping sensitive information safe. This means you can test your ideas quickly and effectively without any risk. With NayaOne, you can generate custom datasets that reflect different customer behaviors and market conditions. This speeds up your development process, allowing you to bring products to market faster and improve the accuracy of your models, leading to better insights and decisions.

Several factors play a role in this, including:

Regulated Environments: Banks function within highly regulated frameworks, which can delay both approval and implementation processes.

Complex Approval Networks: The extensive web of approvals required within banks can be both intricate and time-consuming.

Legacy Infrastructure: Outdated technology and systems often obstruct the seamless integration of new innovations.

Frequent Strategy Changes: Banks typically revise their strategies every 8 to 36 months, making it challenging to maintain focus on a single initiative long enough to bring it to fruition.

Time to Market: The pathway from concept to delivering a product to customers can span 2.5 to 3 years, although extraordinary circumstances, like a pandemic, can significantly shorten this timeframe.

NayaOne navigates a competitive landscape where many vendors provide components of the platform. However, none deliver a comprehensive end-to-end experimentation toolkit that unifies vendors, data, sandboxes, and governance into a single, cost-effective solution. This unique approach minimises the risks associated with experimentation, allowing teams to innovate with confidence and efficiency.