Oliver Platt

Product and Marketplace Manager

Global summits, alarming climate change and sustainability reports, and already visible effects of climate change have led to the rise of conscious consumerism throughout the world.

Regulators and supervisory authorities are also increasingly active in enforcing regulatory guidance and mandates on financial institutions to nudge them towards sustainable alternatives.

Financial institutions (FIs) are finding themselves at the sustainability crossroads. The role of FIs, as significant agents for capital intermediation between investors and organisations, is extremely critical in the transition away from a fossil fuel-dominated economy. This transition has its own share of challenges such as differences in terminologies used across sectors and geographies, several unethical practices such as greenwashing, and insufficient ESG focus from board members and senior management. This has forced financial regulators, across the globe, to introduce various ESG mandates and sustainable finance regulations to ensure FIs begin to prioritise and embrace ESG imperatives.

Sustainable Finance Regulations: A Clarion Call by Regulators

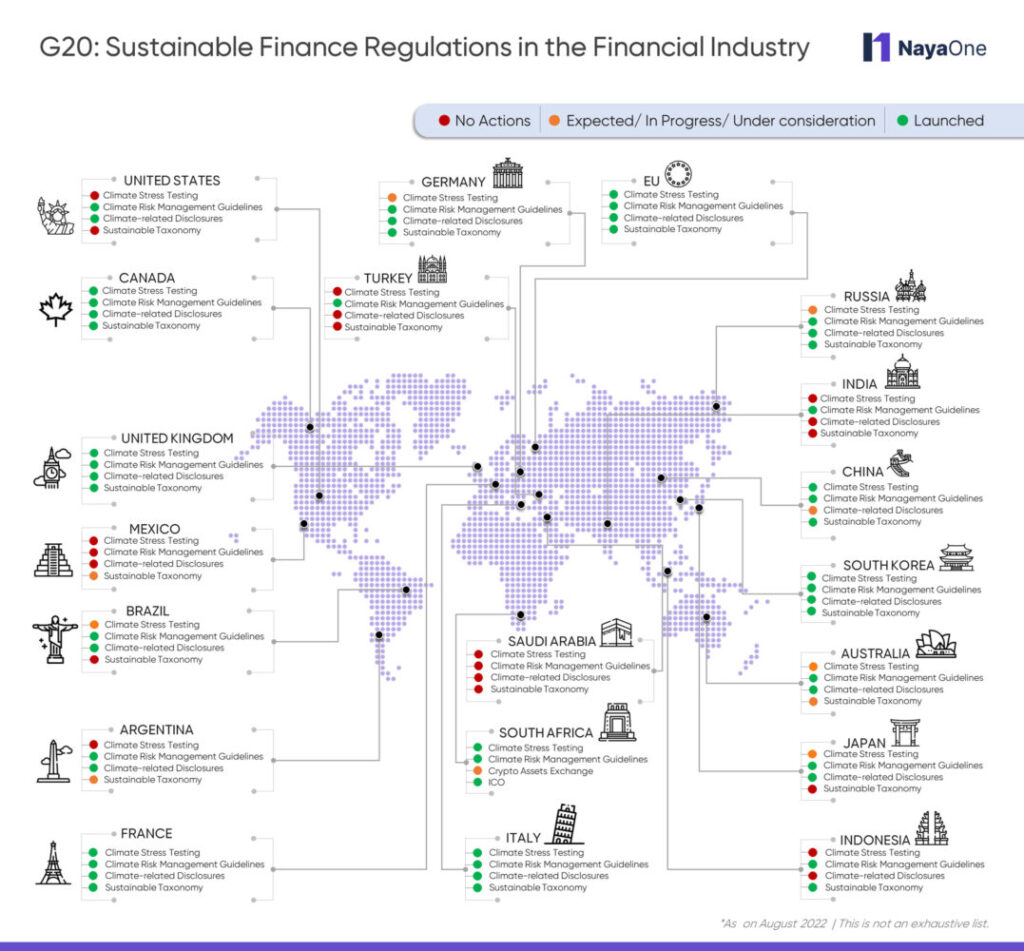

In this post, we take a closer look at some of the prominent measures undertaken by the regulatory authorities and policymakers in the G20 nations. Below is a categorisation of some of the prominent initiatives that are being implemented in the financial sector:

- Climate stress testing involves aggregating model results to generate a perspective on a firm’s overall climate risk.

- Climate risk management guidelines is a structured framework to integrate climate-related and environmental risks into credit, operational, market and liquidity risk management decisions

- Mandatory reporting of climate-related disclosures are to ensure that the effects of climate change are routinely considered in business, investment, lending and insurance underwriting decisions and the same are reported to agencies.

- Sustainable Taxonomy is a set of criteria that provide the basis for an evaluation of whether and to what extent a financial asset will support given sustainability goals.

A Round-Up Of Sustainable Finance Regulations And Measures In G20 Nations

Nations can be further classified based on their responsiveness towards implementing sustainable finance guidance and mandates to the financial sector. The below exhibit captures the status of regulatory initiatives around sustainability in the G20 nations.

Sustainability frontrunners: European members stand out as one of the most proactive players in the race towards net zero.

- The UK, along with climate stress testing, came up with multiple climate risk management guidelines including ones that set out expectations of the Prudential Regulatory Authority (PRA) regarding the incorporation of climate risk management practices, strategies, and long-term plans. Additionally, the PRA laid out a green policy that mandates big financial institutions to assess climate risks alongside their internal capital adequacy assessment processes and risk and solvency assessments. The UK government also launched a Green Technical Advisory Group to provide independent advice on the market and regulatory considerations around the taxonomy that prioritises providing better data on the environmental impacts of firms, supporting investors, businesses, and consumers to make green financial decisions and accelerating the transition to net zero.

- France, along with mandatory climate-related disclosures, also has three other sustainability-linked disclosure rules. They include the Climate Energy Law which is the local implementation of the EU’s Sustainable Finance Disclosure Regulation aimed at improving the reporting standards that require financial companies to explain the implementation of green policies, Article 173 of the French Energy Transition Law that strengthened the requirements for mandatory climate-related disclosures in the annual reports of listed companies, credit institutions, and institutional investors, and the Corporate Transparency obligations in social and environmental matters that requires listed companies and unlisted companies with over $101M total assets and an average of 500 employees to include environmental and social information in annual reports.

- Similarly, countries like Germany and Italy have also launched their respective climate action plans, mostly in line with the EU.

Active implementers: This category includes countries where Central Banks are in the process of laying out plans to counter climate change with an ever-increasing emphasis on green finance.

- The United States has seen multiple initiatives from various regulatory agencies for climate-related issues. In April 2022, the Federal Deposit Insurance Corporation (FDIC) issued a proposed set of principles for large banks under its supervision to identify and address climate-related risks to their businesses. A similar principles guideline document was issued by the Office of the Comptroller of the Currency (OCC) in December 2021. In September 2022, Michael Barr, Vice-Chair for Supervision at the Federal Reserve Board of Governors, announced that the Federal Reserve would take its first steps to require financial institutions to assess risks related to climate change. Further, Barr also confirmed that the Federal Reserve would join the Principles for Climate Risk Management for Large Banks, issued in draft form by the FDIC and the OCC.

- Australia published a Prudential Practice Guide on managing financial risks from climate change under the Australian Prudential Regulation Authority (APRA) in November 2021. APRA also conducted a voluntary climate risk self-assessment survey between March and May 2022. The results of the survey were presented in August 2022 through an information paper.

- Japan launched a pilot scenario analysis exercise on climate-related risks based on common scenarios in 2021 which was completed in August 2022. The Financial Services Agency (FSA) and the Bank of Japan (BOJ), in cooperation with three major banks and three major non-life insurance groups, conducted a pilot scenario analysis and published a report that outlines key results and takeaways of the exercise.

- The Central Bank of Mexico along with UNEP developed a report “Climate and Environmental Risks and Opportunities in Mexico’s Financial System from Diagnosis to Action”, that suggests the development of a national green taxonomy aligned with international best practices, and a road map for the transition of the Mexican sector to a sustainable economy.

Getting off the blocks: These include regions where the impact of green finance is recognised; however, establishing a formal framework is still under consideration or is at a nascent stage.

- India, although it is yet to have a mandatory climate disclosure rule, there are two separate guidelines for ensuring sustainability, introduced by the Securities and Exchange Board of India. The National Guidelines on Responsible Business Conduct mandated ESG reporting for the country’s largest 1,000 companies by market cap, 2022-23 onwards and the Disclosure Requirements for Issuance and Listing of Green Debt Securities contains a list of project and asset categories that fall under green debt securities and requires issuers to make certain disclosures including a statement of environmental objectives of issuance, details of the system, and proceeds of the issues.

- Turkey has published a Sustainability Guide that sets out what companies should pay attention to in order to meet investor expectations on the sustainability front but is yet to make ESG disclosures mandatory or draft any sustainable taxonomies.

Sustainability: A regulatory imperative for financial institutions

The stakes to embrace sustainability initiatives are high for FIs. The pull from the client-conscious customers and the push from supervisory authorities have set unavoidable and urgent imperatives for FIs to take decisive steps to move from a passive position to become active shapers of the green, sustainable future.

Accelerate sustainability initiatives with NayaOne

NayaOne offers an ESG Marketplace with pre-vetted ClimateTech and ESG Data providers for financial institutions to quickly discover and onboard for innovation projects. It also offers an integrated Innovation platform and Synthetic ESG datasets to aid rapid experimentation, evaluation benchmarking, and launch of sustainability propositions to customers.