Amrit Satpathy

Ecosystem Manager

Financial institutions and fintech providers move to bridge the gap

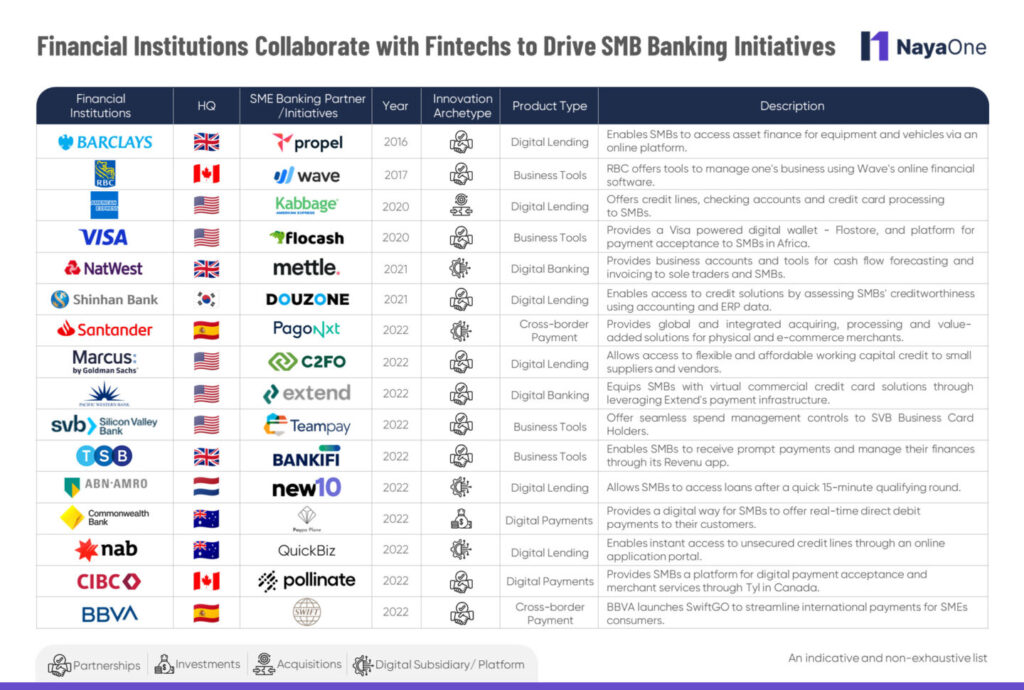

Acknowledging the underserved status and the potential of the SMB segment, fintechs providers and alternative lending sources are revolutionising the state of SMB banking by introducing a slew of digital banking services and business automation tools. Financial institutions (FIs) are equally hot on their heels in revising their approach toward SMB lending, closing the gap between the supply and demand of bespoke products and addressing fragmented processes via offerings such as access to revenue-based finance, virtual credit card offerings, and payment systems to help streamline business operations. In order to secure their market standing, traditional banks are following a multi-pronged approach to help SMBs.

Detailing the multi-pronged approach to re-imagine SMB banking

1. Fixing financing for SMBs

2. Digital business tools to power digital SMBs

- Visa joined hands with FloCash, a payment wallet company, to launch Flostore, powered by a Visa digital wallet and the Flocash pan-African payment platform, which can help small businesses accept digital payments, manage supplies and access financial services across Africa.

- TSB Bank teamed up with BankiFi in the UK to introduce Revenu, an app that offers a simplified payment system and access to working capital credit to ease chasing long-overdue payments.

3. Crossing the cross-border payments chasm

Given the global growth in e-commerce, SMBs have expanded their footprints across different countries and in this context cross-border payments are a critical factor to support their market expansion objectives. Below are some of the initiatives from financial institutions in how they are proactively helping SMBs in processing complex international payments:

- With its subsidiary PagoNxt, Santander has enabled SMBs access to instant payment solutions across Europe.

- In 2021, BBVA became the first Spanish bank to launch SWIFT Go to streamline international payments for SMEs. Several other banks such as Bank of New York Mellon, DNB, MYBank, UniCredit, Sberbank, and Société Générale also participated in the launch of SWIFT Go.

A new horizon for SMB banking

Reimagining banking services for SMBs can unlock new and sustainable revenue streams for incumbent banks. With electronic and API-based access to SMB data such as sales transactions, supply chain activities, payroll expenses, marketing and advertising expenditures, banks are in a position to re-architect digital payments, credit underwriting, and several other banking services for SMBs. A large number of SMB-focused Fintech infrastructure firms also enable banks to accelerate their SMB banking initiatives and quickly launch contextual products for business customers.

Reimagine SMB finance with NayaOne marketplace

NayaOne helps financial institutions get instant and API-based access to a wide variety of SMB-focused FinTech infrastructure innovators on its Marketplace.