Oliver Platt

Product and Marketplace Manager

Not long ago, paying attention to environmental, social, and governance (ESG) issues was of peripheral interest to enterprises. Now, companies from big tech to startups are scaling up their sustainability efforts. ESG has also become a critical factor in navigating the future of banking.

In recent years, there has been a remarkable shift in corporates’ ESG responsibilities, and sustainability stewardship has become a board-level agenda. Financial services institutions have access to the financial data of consumers and businesses. Therefore, they have an unprecedented opportunity to play a pivotal role in the transition towards a sustainable world.

Stakeholders’ Pressure Drives ESG Relevance

Since the pandemic, there has been a growing international interest in the impact of climate change on the planet. Due to that, regulators, consumers, employees, and investors have all rallied around the sustainability agenda.

Since the 2021 UN COP26 climate-change conference in Glasgow, several governments have publicly declared a trajectory to net zero. This has resulted in increased participation by the regulators from several countries. The UK, Japan, and Hong Kong have translated governments’ net zero commitments into laws. This is forcing companies to review their carbon footprint and periodically disclose their ESG performance to stakeholders.

In April 2021, the European Commission adopted a proposal for a Corporate Sustainability Reporting Directive (CSRD). It amended the existing reporting requirements of the NFRD (Non-Financial Reporting Directive).

The proposal extends the scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises). It also introduces more detailed reporting requirements according to mandatory EU sustainability reporting standards.

In April 2022, The European Parliament backed amendments to extend the scope of the CSRD. It aims to include large international corporations selling goods and services in the EU.

In November 2023, California became the first US state to pass ESG disclosure laws. Meanwhile, the SEC passed climate-related disclosure rules, prompting investors to pay more attention to ESG initiatives.

Consumers and employees have come to see the importance of sustainability. According to a PwC 2021 report, 83% of consumers think companies should actively shape ESG best practices. Meanwhile, 86% of employees prefer to support or work for companies that care about the same issues they do.

Sustainability has also become a crucial factor in attracting talent as younger generations, especially, are keen on working for a company with purpose.

Demand Drivers for Sustainability in the Future of Banking

Sustainability will dictate the future of banking. Climate change is gaining more traction amongst environmentally conscious consumers. There is also an increasing demand for ways to measure and identify the impacts of their spending patterns on their carbon footprint.

Consumers now expect firms to help them make sustainable lifestyle choices by enabling them to factor sustainability into their consumption decisions. A report by the IBM Institute for Business Value (IBV) proves that. It found that 93% of global respondents feel that the pandemic influenced their views on sustainability. Another IBM survey from February 2022 found that 51% of respondents consider environmental sustainability more important than 12 months prior.

Businesses have a key role in accelerating the low carbon transition and helping the world achieve the Paris Agreement target by 2030. Each industry needs large cuts in GHG emissions, coupled with compensatory measures. Tree plantation or investments in carbon offsetting projects can also accelerate the journey towards net zero emissions.

Supply Side Undercurrents for Sustainability

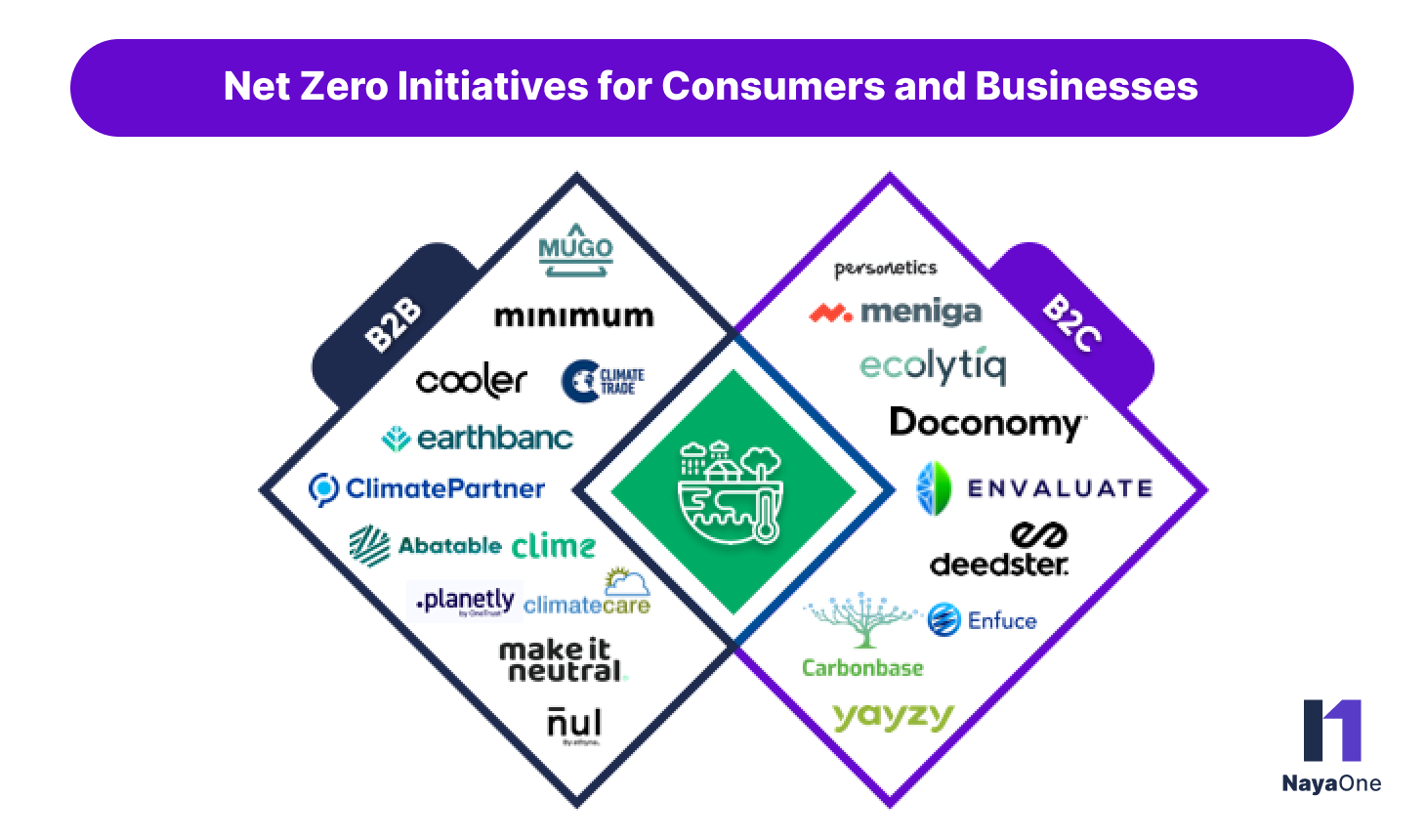

Significant market demand has led to a deluge of technology providers offering carbon footprinting, emissions accounting, and integrated carbon offsetting platforms. These specialist ClimateTech providers have built specific sustainability services targeted at consumer and business segments. The diagram below shows some of these ClimateTech providers for B2B and B2C propositions.

Embedded Eco-friendly Banking Propositions for Customers

Banks have a unique opportunity to help consumers and businesses understand their carbon footprint and take retrospective and pre-emptive actions to minimise it. Banks already have access to demographic, behavioural and transactional data of customers. Banks have frequent interactions with them for various financial activities and enjoy a significant level of trust. This makes banks a preferred and suitable organisation to offer sustainability advice to customers.

In the era of Open banking, banks have also started sharing consent-based data with third parties. This helps build customer-centric financial and lifestyle services, often integrated within the banks’ applications. This opens up the possibility for banks to offer sustainability services to their customers. They can embed the offerings from ClimateTech providers for both retail and enterprise clients. There are critical upsides for banks, their customers, ClimateTech providers, and the planet to unleash a win-win situation for all the stakeholders involved.

In addition to meeting the demands of carbon conscious consumers and businesses, eco-friendly banking also helps banks to meet regulatory requirements. It aligns their business models with the global sustainability agenda. It also improves brand reputation, especially among Gen Z and Millennials.

Accelerate Sustainability Efforts with NayaOne

Eco-friendly and sustainable initiatives are integral in the future of banking. However, due to regulatory constraints, risk aversion, and security concerns, big banks are slow to innovate. Partnering with fintechs can help traditional banks leverage their tech talent, accelerate innovation cycles, and remain up to date with ESG developments.

NayaOne offers an ESG Marketplace with pre-vetted ClimateTech providers for financial institutions to quickly discover and onboard for innovation projects. It also provides an integrated digital innovation platform and ESG datasets.

As a result, financial institutions can benefit from rapid experimentation and evaluation benchmarking. They can accelerate digital transformation and launch sustainability propositions to customers.