Kris Dickinson

Director, Financial Services

As we move further into the UN’s Decade of Action, climate-consciousness is fast becoming a defining attribute of consumers and businesses alike. More and more consumers are holding governments, corporations, and themselves accountable for their actions towards building a sustainable future.

COP26 kept the 1.5C commitment from the Paris Agreement alive but accelerated action to address the climate emergency is now required. This presents an opportunity for proactive action across industries—with financial services as a crucial contributor. Most of what we do flows through money and any effective climate change strategy should start at the grassroots of consumption.

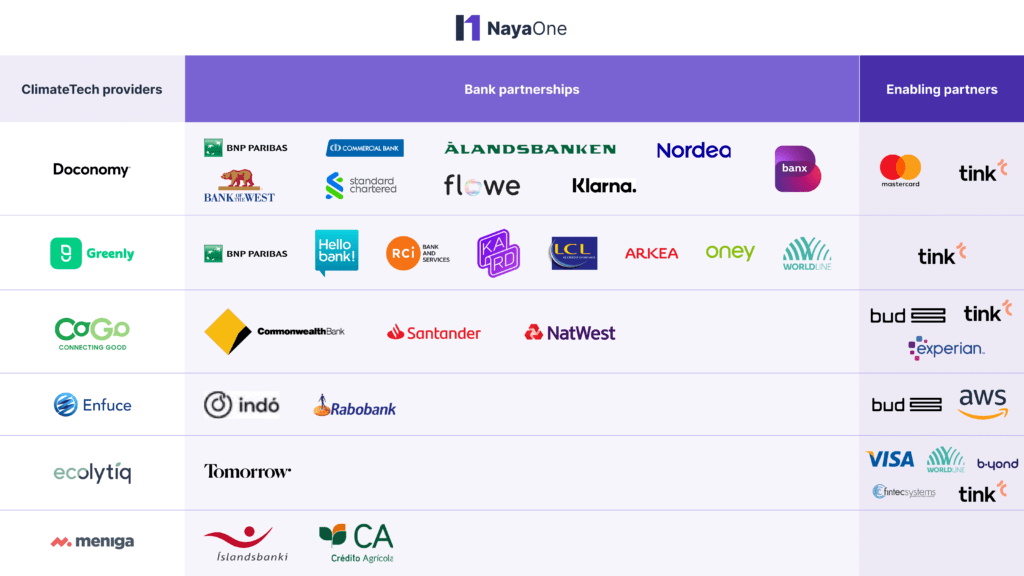

A Mastercard survey shows 54% of adults see reducing their carbon footprint as more important now than pre-pandemic. Financial institutions, taking heed of this interest are launching carbon calculation tools for consumers—some examples being those launched by NatWest, Santander, and BNP Paribas. Card networks like Mastercard and Visa are also partnering with software-as-a-solution providers like Doconomy, and ecolytiq respectively to enable their partner networks to easily integrate carbon calculators and other sustainability solutions into their products.

How does carbon footprint tracking work?

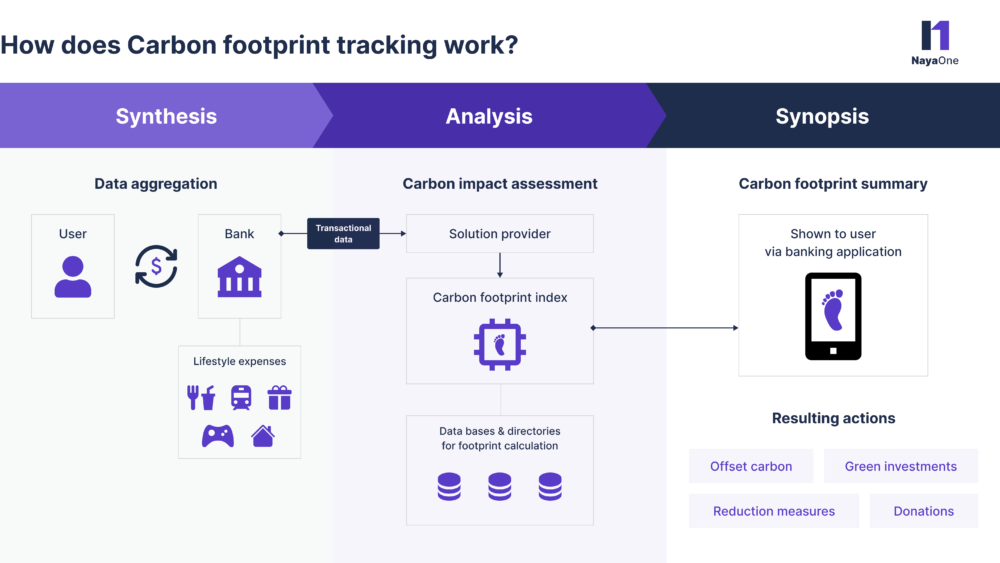

To understand how a carbon footprint tracking solution enabled by a bank works, we can segment the process into three phases.

*Mastercard Unveils New Carbon Calculator Tool for Banks Globally, as Consumer Passion for the Environment Grows.

The carbon calculation tools themselves are based on elaborate frameworks that take into account various established algorithms; merchant category codes to identify transaction types, carbon impact as per product, country-level metrics, and other databases. The transactions are matched to industries, and consumer habits such as diet or lifestyle, and their resulting emissions (carbon dioxide equivalents or CO2e) are calculated.

This analysis produces the real-time carbon footprint summary of a user and is presented to them via the banking app. In addition to showing the carbon impact, users are also prompted towards recommendations for reducing or offsetting carbon impact, investing or supporting green initiatives, and more.

How do banks integrate carbon footprint calculators?

Carbon calculation service providers integrate with banks in multiple ways; from collaborating via APIs to independent white-label solutions that can be embedded into the bank’s tech stack.

In most cases, solution providers integrate via APIs to enable on-demand use of services and allow clients to control the customer-facing interface. Transactional APIs allow a consistent flow of data and real-time updates of carbon insights.

Some, like CoGo, Doconomy, ecolytiq also offer white-labelled applications that can be bought off the shelf and plugged directly into existing banking solutions with minimal customisations.

The As-a-service Model for Sustainable Finance

In the coming years, service providers building tools facilitating sustainable finance will be prime attractions for consumer-facing entities. The digital infrastructure required for such collaboration will also be crucial. Building on the open flow of data backed by customer consent, enablers can drive impact across the value chain. Data-driven simulations for testing will enable more robust solutions that can provide more accurate outputs and calls to action.

The first-mover pull of carbon footprint tracking tools has spurred many financial institutions into action. As sustainable finance becomes more mainstream, the demand for such ESG-centric (environmental, social, and governance) use cases will grow rapidly.