Kris Dickinson

Director, Financial Services

Buy now, pay later, or BNPL, isn’t new. However, due to its convenience and lack of interest rate, it has been gaining growing popularity, especially among younger generations. It allows merchants and small businesses to make their products and services more easily available. By paying in installments, their customers reduce the financial burden and are more likely to shop during economic downturns. As a result, the adoption of white-label BNPL solutions is increasing among both financial institutions and non-financial ones.

Internet-first point-of-sale financing, which includes BNPL providers, raised a total of $4.48B in 2021. This is about 50% more than funding raised in 2020 & 2019, when the segment attracted $3B and $2.86B, respectively.

The global BNPL Market Size was worth $25.4 Billion in 2022 and is expected to reach $160.7 Billion by 2032.

With mild regulatory headwinds, there may be some caution required for skyrocketing pay later unicorns. Regulations will have a significant impact on the way this segment progresses in the future. Regulatory guidance will enable incumbents to more confidently launch pay later solutions. They’ll be able to leverage their brand and consumer trust to provide convenient yet affordable solutions for retail consumers.

In recent years, modular tech services-based B2B arrangements, with banks providing the balance sheet for loan origination services, has enabled non-licensed and non-financial companies to offer financial services using ready-to-launch solutions. BNPL is one such solution that has emerged and is being used by non-bank entities to provide more instantly gratifying purchase experiences for customers. This phenomenon is also referred to as embedded finance, where non-banking entities embed financial services in customer journeys.

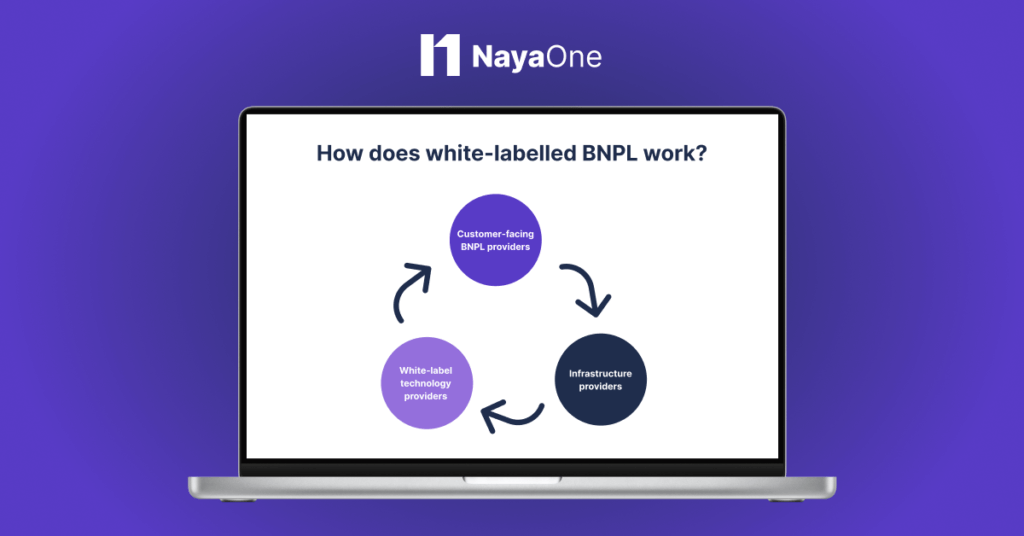

How Does White-Label BNPL Work?

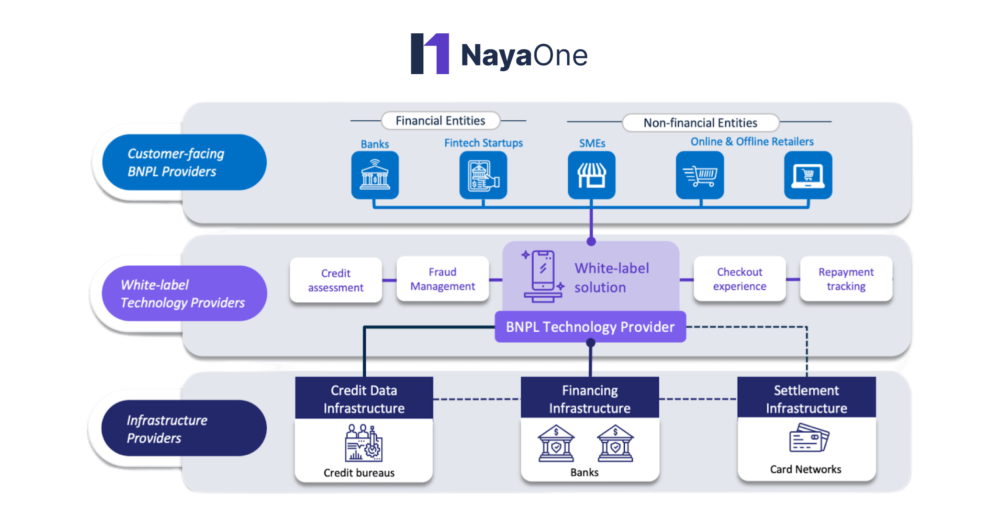

White-label BNPL technology providers operate on a two-sided model. On one side, they integrate with various infrastructure providers, delivering things like credit data and payment settlement. On the other end, they integrate with customer-facing entities that embed their BNPL solutions to deliver services to end consumers.

The backend strategic partners enable them to provide financial services without the need to acquire specific operational licenses. Banks, credit bureaus, and card networks play distinct roles in the payments and credit value chain.

The BNPL tech provider, which forms the intermediate layer, commands the technology integrations that orchestrate the buy now, pay later service. It also assumes responsibility for stages of the transaction, such as:

- Credit assessment at the time of assigning credit limits,

- Fraud management at the time of processing,

- The end-to-end checkout experience for customers,

- Repayment tracking upon purchase completion,

- And more related tasks.

At the front end, customer-facing entities fuse with the BNPL intermediary for the white-label BNPL solution. As a result, they can start offering their customers buy now, pay later options with some customizations. Both financial and non-financial entities can plug in these solutions as required to reduce the time to market for the offering.

For non-financial entities, the goal is to provide a frictionless checkout experience and more payment options to their customers. Financial institutions, on the other hand, may want to provide a more horizontal service. They can activate buy now, pay later options on customers’ debit cards or even issue single-use virtual cards for BNPL.

How do banks integrate BNPL solutions?

Banks can essentially be a part of the BNPL value chain in two ways:

Starting with the most obvious play, banks can become backend partners as a part of a multi-lender marketplace for buy now, pay later platforms. This enables them to diversify their books without having to actively participate in end-consumer relations and service management.

Alternatively, banks can partner with fintech solution providers to offer buy now, pay later options to their customers. In this instance, banks become both the consumer-facing entity and the financing infrastructure provider. Meanwhile, the white-label BNPL tech provider acts as an add-on servicer. This allows banks to offer BNPL options to customers on their existing debit and credit cards that can be used across various purchase journeys. Banks may also issue single-use virtual cards created specifically for a pay later transaction lifecycle. This provides an additional layer of security while transacting online.

The Rise of Buy Now, Pay Later

Buy now, pay later offerings move up the fintech hype curve driven by consumer demand, investor capital, and the fear-of-missing-out. Therefore, both financial and non-financial institutions are evaluating strategic options to become a part of the customer acquisition magnet that is BNPL.

Time is of the essence. The players, especially banks, that manage to provide consumers with these offerings will be the ones adding to their competitive advantage.