The Platform to

to Validate and Deliver

New Technology

NayaOne gives enterprises the infrastructure to discover, validate, and deliver new technology with speed and control. Workspaces, data libraries, and a pre-integrated vendor ecosystem - all built for regulated environments.

Run Proof-of-Concepts

in Secure Workspaces

Test vendors side-by-side in enterprise-grade, air-gapped environments. Each workspace comes with built-in governance, audit trails, and full visibility - so your teams can move fast without losing control.

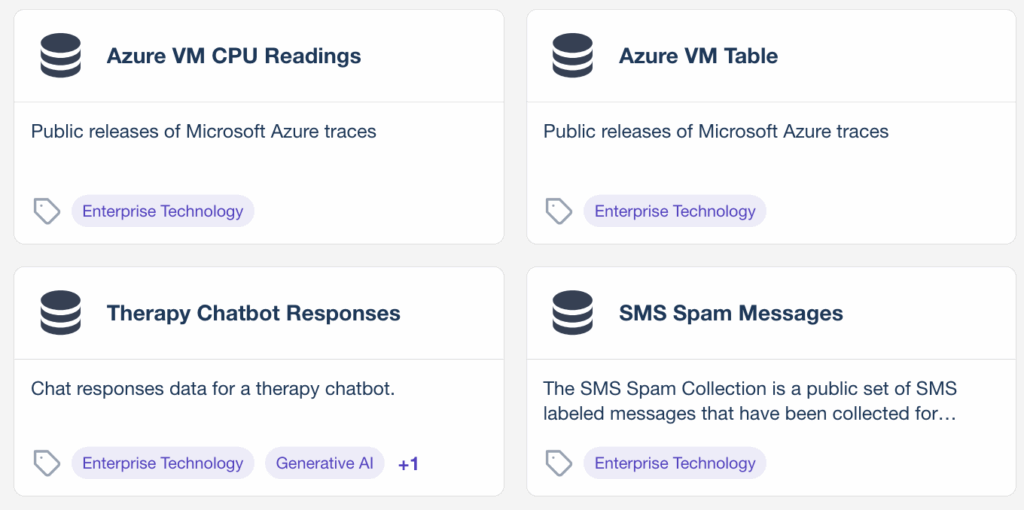

Synthetic Data That Looks and Behaves Like Production

Generate structured, semi-structured, and unstructured data to test new vendors without exposing sensitive information. From loan applications to payments flows, our libraries cover the datasets enterprises need to validate solutions safely and fairly.

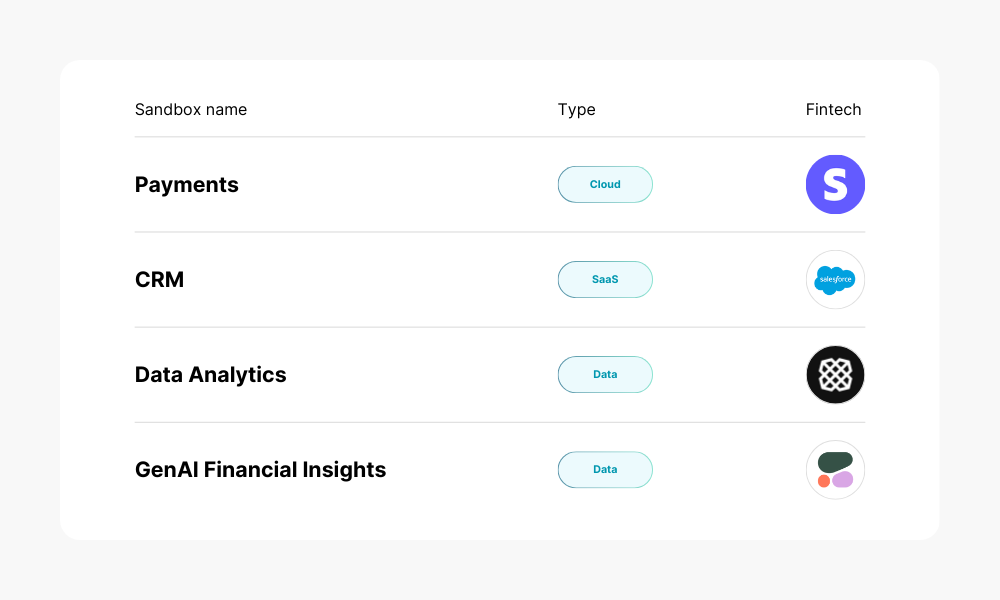

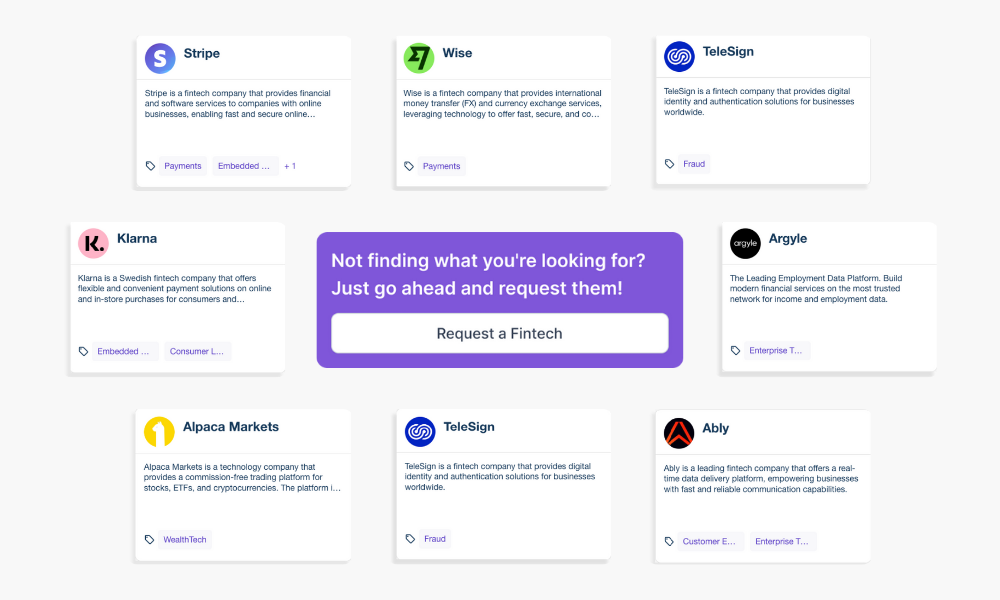

Instant Access to

Pre-Integrated Vendors

The Enterprise Gateway connects you to hundreds of pre-integrated vendors through a single interface. Discover new capabilities, connect instantly, and start proof-of-concepts without the cost or delay of bespoke integrations.

Build for Regulated Enterprises

Every component of the platform is designed for compliance and oversight. Security, auditability, and analytics are not add-ons - they’re built into every workspace, dataset, and vendor connection.

01

For Enterprises

Banks and insurers use NayaOne to test vendors with production-like data, compare solutions side-by-side, and make decisions with confidence.

02

For Regulators

Supervisors and policy makers use NayaOne to run secure experiments, trial new frameworks, and understand risks before scaling to the market.

03

For Vendors

Vendors access a single integration point to connect with enterprises, demonstrate value in controlled PoCs, and shorten sales cycles.

Faster Delivery. Lower Risk. Real Results.

With NayaOne, enterprises move from vendor discovery to decision in weeks, not months - with cost, speed, and evidence all built into the process.

Time-To-Value

Cut vendor onboarding from

6 – 12 months to 6 weeks using pre-integrated vendors and secure PoC workspaces.

Cost Efficiency

Reduce validation costs by

60 – 70% with synthetic datasets that replace the need for expensive, bespoke testing environments.

Execution Speed

Accelerate delivery roadmaps by 3 – 5x with a platform built to run multiple vendor PoCs side-by-side, fairly and repeatably.

Evidence-Base Decisions

Make confident build-versus-buy choices with governance, audit trails, and analytics baked into every proof-of-concept.

One Platform.

Multiple Use Cases.

A single platform to run proofs-of-concept across every business line. One integration, endless ways to test and deliver new technology.

CUSTOMER LIFECYCLE

Identity and Onboarding

Generate synthetic identity documents and onboarding records to safely test KYC/KYB and customer verification processes - without using real customer information.

- Identity Document Sets

- Customer Onboarding Forms

- KYB Company Records

FRAUD AND FINANCIAL CRIME

Fraud and Risk

Generate datasets that include edge cases, anomalies, and suspicious patterns so risk teams can test fraud detection models and resilience - without exposing live customer data.

- Fraudulent transaction records

- Anomalous Account Activity

- Suspicious Case Logs

RISK AND COMPLIANCE

Regulatory Compliance

Generate datasets that replicate reporting obligations and audit scenarios, helping compliance teams validate systems against regulatory standards without exposing sensitive data.

- Transaction Monitoring Records

- Audit Trail Datasets

- Regulatory Reporting Files

CREDIT AND LENDING

Lending and Credit

Create loan application, repayment, and credit history data that mirrors production environments, enabling fair testing of credit decisioning tools and lending platforms.

- Loan Application Data

- Repayment History Tables

- Credit Score Reports

INSURANCE

Claims and Insurance

Produce synthetic claims, policy, and payout datasets so insurers can test AI, automation, and fraud detection in claims processes — all without customer exposure.

- Insurance Claims Records

- Policyholder Data Tables

- Payout History Files

AI AND AUTOMATION

AI and Model Training

Provide high-volume, production-like data for training and testing AI/ML models, ensuring governance and compliance without relying on customer datasets.

- Tabular Training Datasets

- Synthetic Text Corpora

- Balanced Demographic Data

What Our Customers Say

positioning us well ahead in the digital transformation and AI race.

giving enterprises a clear path to innovate and deliver ROI faster.

Shout out also to our partners Amazon Web Services (AWS) and NayaOne.

who drive responsible innovation at Valley.

Explore How NayaOne Can Work for You.

Whether you need to validate AI vendors, trial cybersecurity solutions, or build a business case for payments innovation -

NayaOne gives you the environment to do it with confidence.

FAQs

NayaOne provides pre-integrated vendors, synthetic data libraries, and secure workspaces. This removes the need for custom integrations or bespoke test environments, cutting onboarding from months to weeks.

Yes. Our datasets mirror the structure, patterns, and behaviours of production data — from transactions to documents — without exposing sensitive customer information.

Absolutely. Every workspace is air-gapped, with audit trails, governance, and compliance controls built in. The platform is designed for banks, insurers, and regulators to experiment safely.

Unlike a standalone sandbox, NayaOne combines vendor access, production-like data, and repeatable validation frameworks in one platform – making it enterprise-ready, not just experimental.

Most PoCs run in about 6 weeks. They start with scoping and vendor selection, move into testing with synthetic data in secure workspaces, and end with evidence-based results that inform build-versus-buy decisions. Timelines can vary depending on the scope and deliverables, but the process is structured to keep momentum and reduce wasted effort.

No. Vendors integrate once into the NayaOne platform, then can be securely connected to multiple enterprises through the Enterprise Gateway.

On average, enterprises cut onboarding timelines by 70%, lower validation costs by 60 – 70%, and accelerate delivery roadmaps 3 – 5x compared to traditional vendor onboarding.