Why Top Financial Institutions

and Large Enterprises

Trust NayaOne

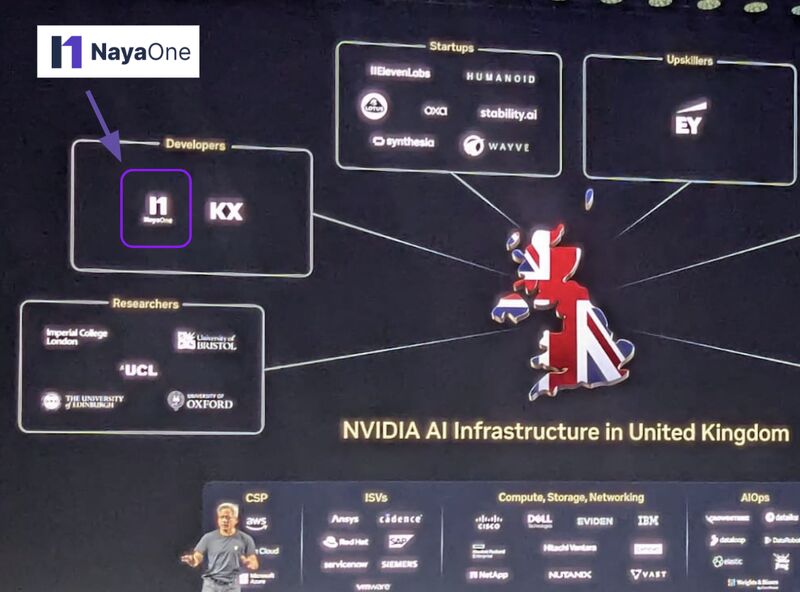

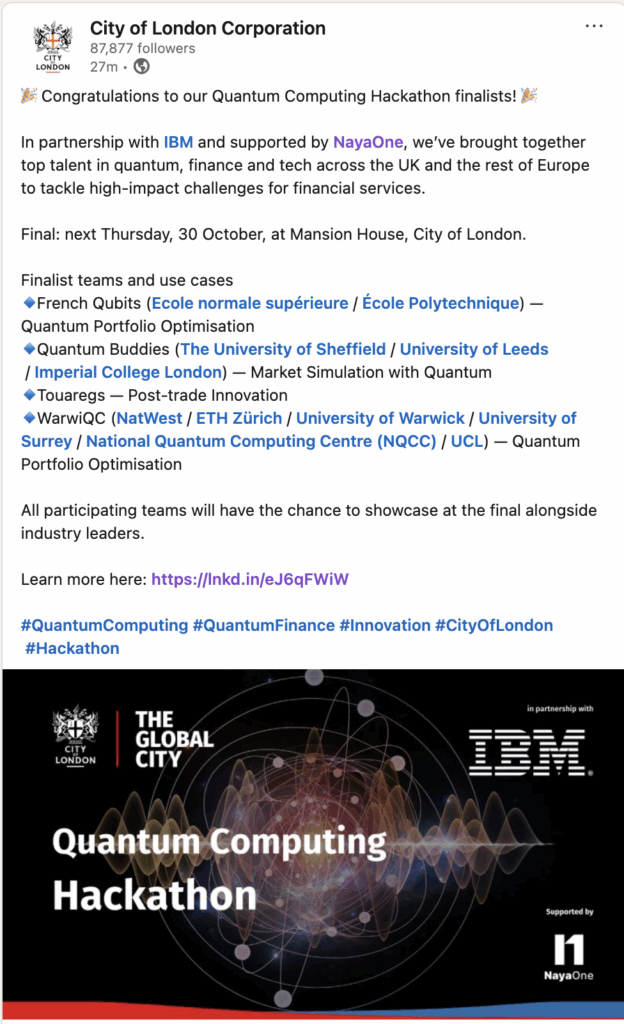

Financial institutions use NayaOne to validate vendors and technologies before onboarding and deployment. Used by global banks, insurers and regulators to reduce delivery risk and accelerate outcomes, across the UK, US, Canada and EU.

Why Institutions Use NayaOne Before Deployment

01

Faster Vendor Decisions

Institutions test vendors early and avoid long validation cycles after selection.

02

Evidence Before Commitment

Teams produce decision-ready evidence before contracts and onboarding begin.

03

Lower Risk After Onboarding

Gaps are discovered during validation, not after integration starts.

04

Safe Testing Without Production Risk

Solutions are tested safely without exposing production systems or sensitive data.

Our Mission

NayaOne’s mission is to help financial institutions and enterprises adopt new technology safely and quickly by providing the infrastructure to discover, validate and scale vendors with confidence.

What Our Customers Say

Our collaboration with NayaOne has dramatically streamlined how we vet fintech vendors,

positioning us well ahead in the digital transformation and AI race.

positioning us well ahead in the digital transformation and AI race.

NayaOne shows what’s possible when ambition meets execution, turning bold ideas into measurable industry impact.

Our collaboration with NayaOne removes the complexity of AI adoption,

giving enterprises a clear path to innovate and deliver ROI faster.

giving enterprises a clear path to innovate and deliver ROI faster.

I want to extend my thanks to all the participants, mentors, coaches, and support teams who made this GenAI Hackathon a success. These events take a village! Thank you for your hard work, enthusiasm and commitment, and I’m excited to see where these innovations will lead us.

Shout out also to our partners Amazon Web Services (AWS) and NayaOne.

Shout out also to our partners Amazon Web Services (AWS) and NayaOne.

Valley is committed to innovating rapidly for our customers while ensuring safety and soundness as their trusted banking partner. This award is a wonderful recognition for our talented teams

who drive responsible innovation at Valley.

who drive responsible innovation at Valley.

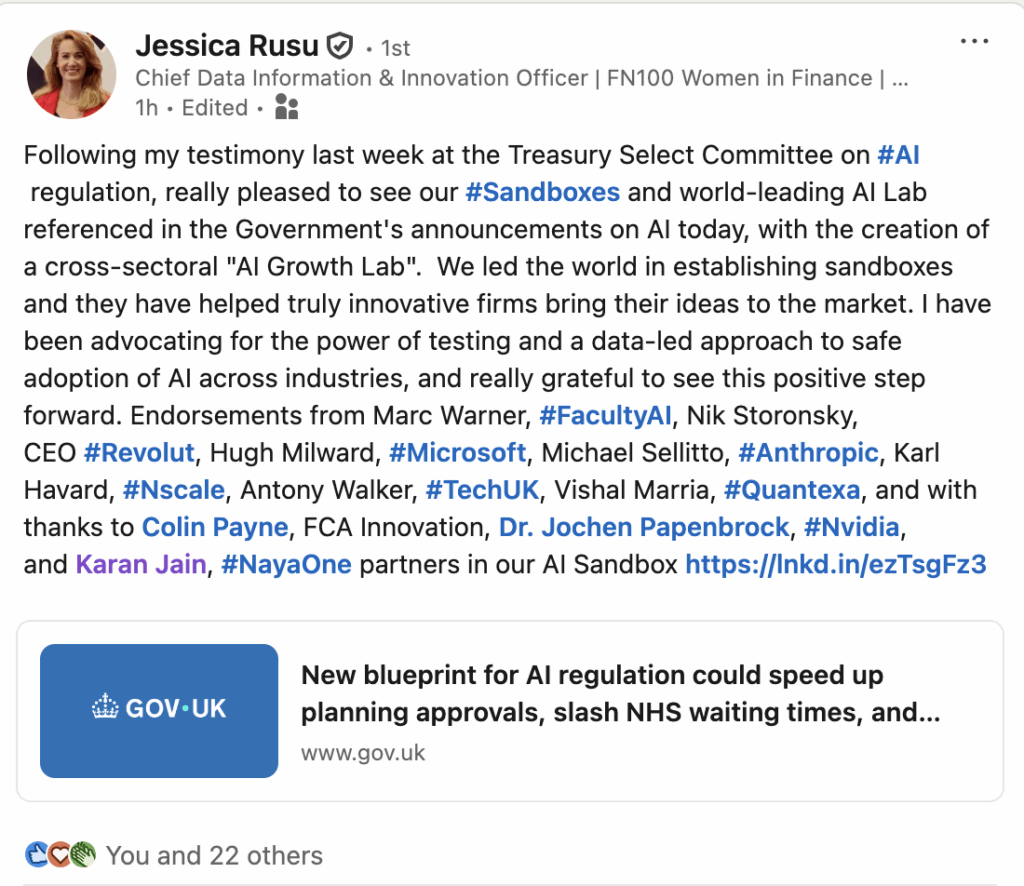

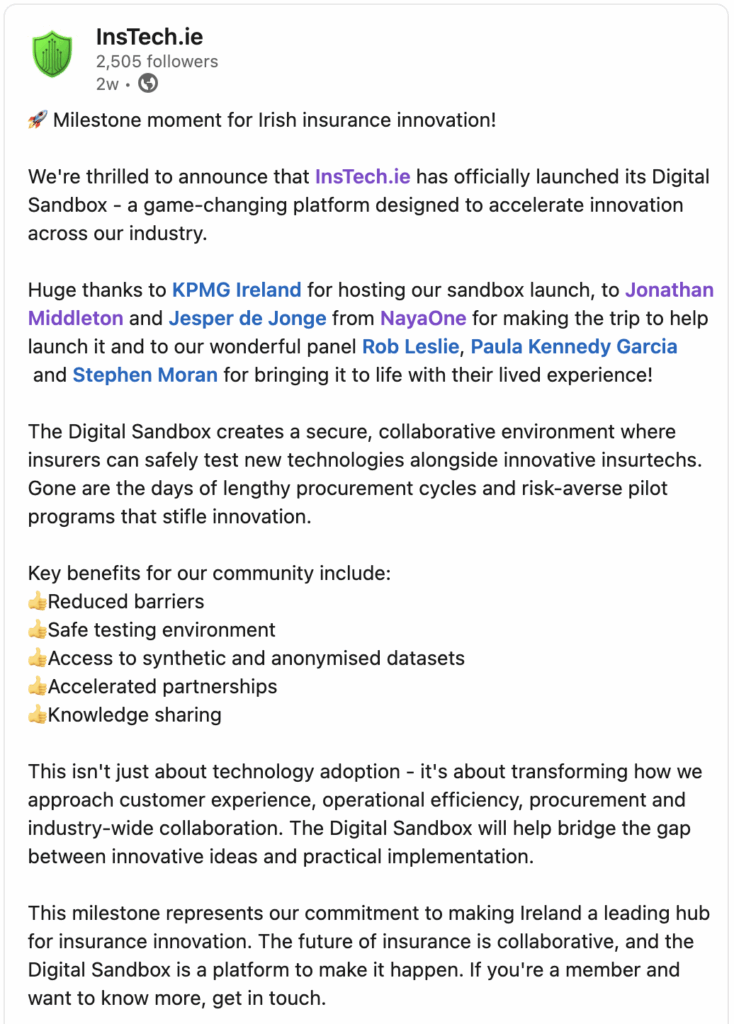

NayaOne brings international know-how and technology to the Czech fintech ecosystem, accelerating both testing and innovation adoption. We’ve secured a partner helping define digital sandbox standards across Europe. Czech startups will have access to the same technology used by regulators in the UK and Ireland.

The FCA's Supercharged Sandbox is a "sandbox on steroids". It combines enhanced AI testing infrastructure with both sparse and rich datasets, high-performance compute, and modern developer tooling. Crucially, it is an environment where first can onboard and test real tools securely, supported by close collaboration with NayaOne as the digital sandbox provider.