#1 Digital Transformation Platform for

Product Teams

Innovation Teams

Tech Teams

Digital Transformation Teams

Embrace the power of fintech and stay ahead of the curve – modernise your bank with NayaOne’s innovative product development platform and fintech marketplace, trusted by top banking institutions.

Security certifications

Features

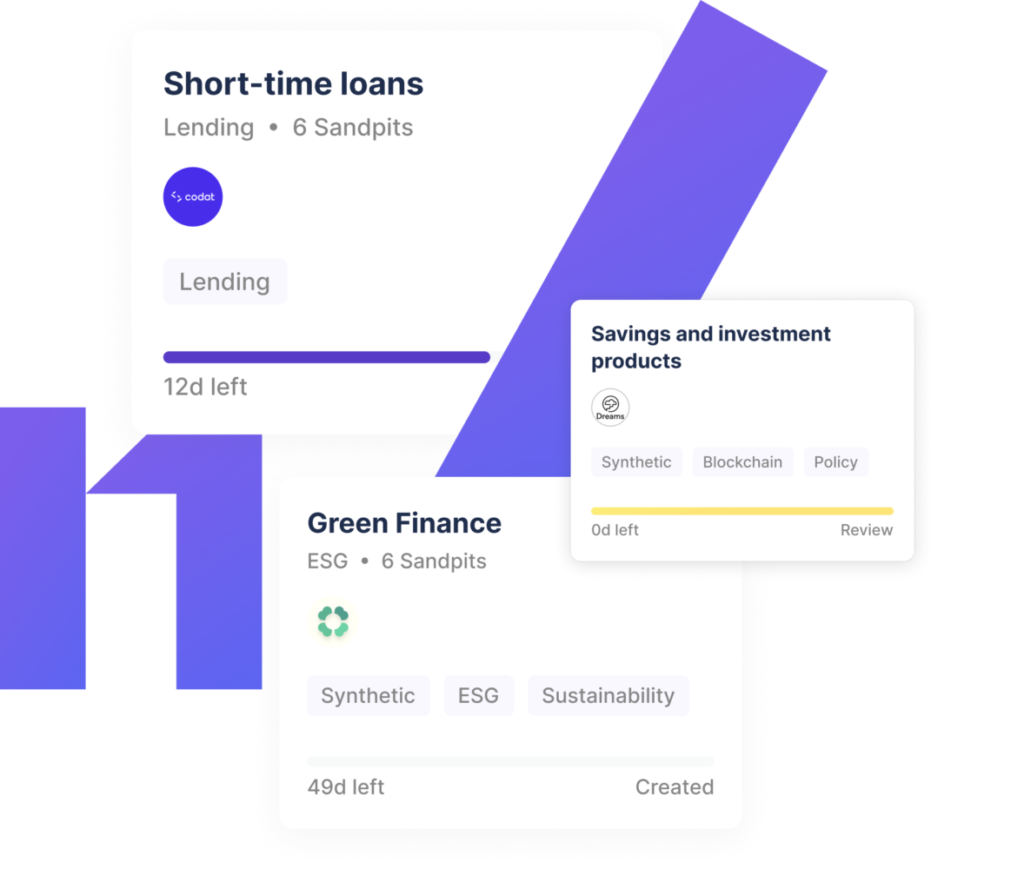

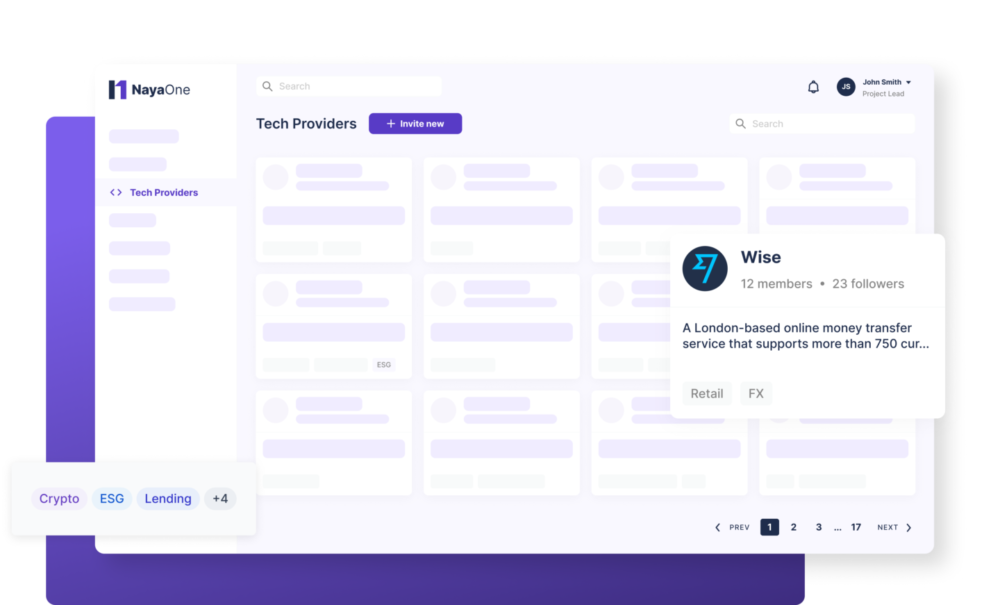

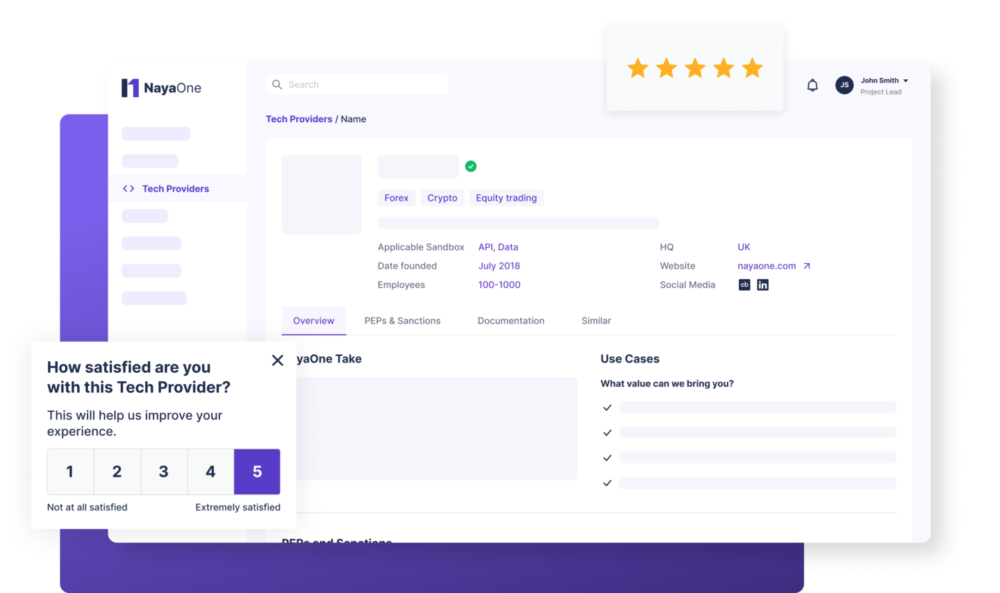

Evaluate Vendors with Confidence

Our marketplace connects you with top vendors in the fintech industry, so you can evaluate and compare their products with ease. We understand that choosing the right vendor can be a difficult decision, which is why we provide you with the tools and resources to make an informed choice.

Run multi-vendor, Proof-of-Concept experiments in 6 weeks

Create Customer Journeys

At NayaOne, we understand that creating seamless customer journeys is essential to retaining customers and driving revenue. That’s why we’ve developed an integrated product development platform that streamlines the process of creating customer journeys and helps you stay ahead of the competition.

Build solutions with one or many fintech partners and gather real-time user feedback

Embedded Finance

NayaOne offers a suite of innovative solutions to help banks deliver embedded finance and distribute new products. With our platform, your bank can expand its reach, increase revenue, and better meet the needs of your customers.

Our API integration capabilities enable seamless integration of your products and services into third-party applications, such as e-commerce websites, aggregate businesses and online marketplaces. This allows you to offer your products where your customers are already engaging, making it easier for them to access and use your services.

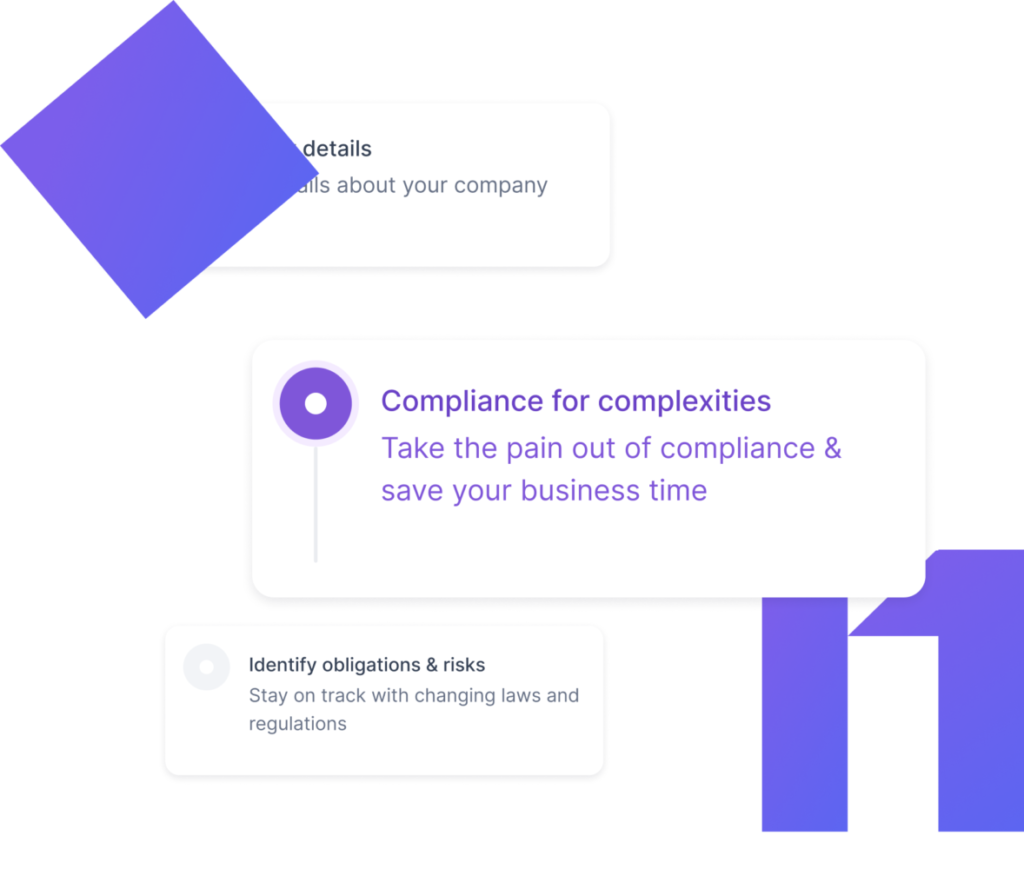

Responsible Innovation

As an industry leader, we recognise the importance of responsible innovation in shaping the future of banking. This not only enhances employee engagement and satisfaction, but also promotes a culture of innovation and entrepreneurship within the bank.

At NayaOne, we believe that responsible innovation is key to ensuring that banks can continue to provide valuable services to their customers, while also protecting the interests of all stakeholders.

Mitigate risk with technical evaluations of solutions, and their integration requirements, in secure sandboxes built for Financial Services

You're in good company

How it all Works

Use the NayaOne platform to drive growth, mitigate risk, and optimise costs. And do it in a matter of days and weeks not months and years!

1. Discover

Access to innovation sourcing marketplace to find, vet, and onboard emerging & enterprise-ready tech providers faster.

2. Evaluate

Use assessment scorecards to evaluate suppliers performance and resilience and confidently award them business.

- 200+ ready-to-use datasets

- 2.5 billion data points

3. Scale

Move through the stages of deployment and beta testing to scale innovation experiments in your own production environment.

- 10+ Enterprise Tech integrations

- 100+ Use-cases delivered

Partner Success Stories

Both companies have partnered to create a business partnership towards promoting KYC services in its ecosystem. That’s why Youverify is excited to partner with NayaOne, to provide financial institutions with a secure environment to test the Youverify product and build confidence in our solution before purchase. This partnership demonstrates both firms’ commitment to empowering financial institutions globally with robust, compliant technology and support bank-fintech partnerships to drive innovation in the industry.

Hakeem AkiodeHead of Growth & Marketing, Youverify

Wequity's excited to be present on the NayaOne platform in order to increase our exposure and visibility to the financial services industry and support bank-fintech partnerships to drive innovation in the industry.

Gabriel LevieCo-founder, Wequity

Regtech, and AML tech in particular, is a high trust purchase for financial institutions with critical infrastructure and sensitive data, and it often requires a lot of faith to change archaic systems. That’s why First AML is excited to partner with NayaOne and provide banks and financial institutions with a secure environment to test the First AML product and build confidence in our solution before purchase. This partnership demonstrates both firms’ commitment to empowering financial institutions globally with robust, compliant technology and support bank-fintech partnerships to drive innovation in the industry.

Bion BehdinCo-Founder, First AML

Our partnership with NayaOne will help to establish us as a leading Fintech-as-a Service provider. Our listing on NayaOne’s Sandbox-as-a-Service Platform provides an invaluable channel for regulated firms to reap the benefits of Xapien’s AI-generated due diligence reports. We look forward to collaborating with the NayaOne team and marketplace customers as we scale our solutions and address new use cases to support bank-fintech partnerships to drive innovation.

John CannonManaging Director, Global Partnerships & Alliances, Xapien

NayaOne has been instrumental in helping us work with banks and financial institutions. They simplify the complexities of working with the regulated market and seamlessly connect us with industry leaders, ensuring the safe and responsible adoption of AI. Thanks to them, we're shaping a future in financial technology that's both easy and innovative and will strengthen NayaOne’s mission to bring bank-fintech partnerships together for innovation.

Abhinav Reddy AppidiCo-Founder and CEO, PureML

We are delighted to announce our new partnership with NayaOne. This collaboration unites NYALA Digital Asset Platform with NayaOne's discovery marketplace, aiming to simplify the accessibility of tokenisation solutions and leading the integration of conventional financial practices with blockchain technology, bringing digital assets to the mainstream. This collaboration is a further step for us to empower the financial industry towards digital transformation and strengthen bank-fintech partnerships.

Daniel WernickeCo-CEO, NYALA

Unblu is thrilled to join the NayaOne tech marketplace, and we look forward to collaborating with banking teams to explore and assess transformative use cases. Our primary objective is to enhance the customer and operational experience through the deployment of Unblu's comprehensive omnichannel client interaction platform. We fully endorse NayaOne's “learning by doing” philosophy and believe that this partnership offers significant opportunities to deliver value to banking institutions and their customers.

Jens RabeCo-Chief Executive Officer, Unblu

We're thrilled to partner with NayaOne, sharing a vision for fintech's future. Showcasing our solution on this platform will extend our reach and benefit our customers and financial partners. As NayaOne brings bank-fintech partnerships together for innovation, we’re delighted to be partnering with them.

Ilan FlaxHead of Strategy, Insait