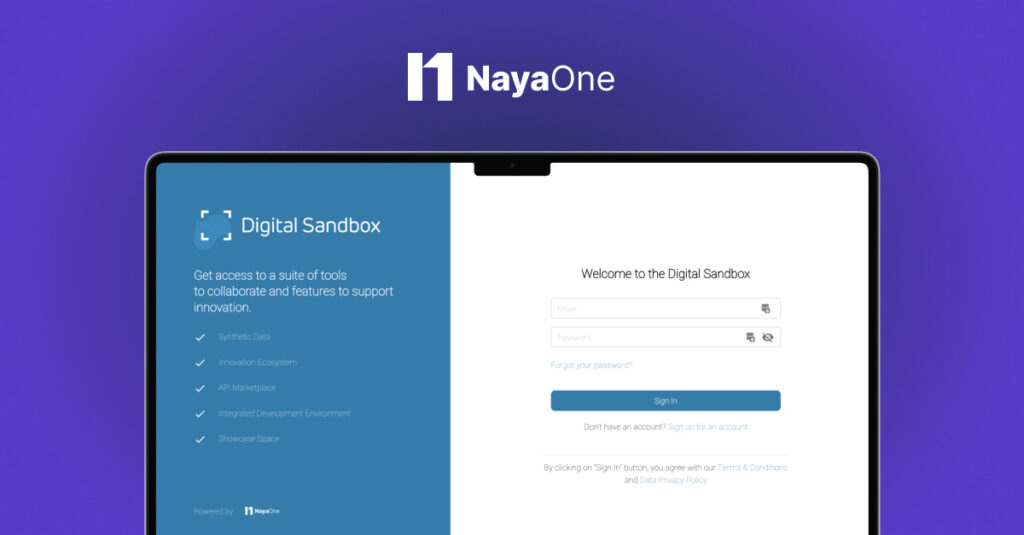

NayaOne selected to build and operate the FCA Digital Sandbox, a ground breaking platform for responsible innovation in financial services.

NayaOne’s success in securing this tender is a testament to the company’s cutting-edge technology and proven track record in digital transformation. As an established player in the fintech ecosystem, NayaOne brings a wealth of expertise and experience to the FCA Digital Sandbox initiative.

We are thrilled to have been selected for this prestigious opportunity to collaborate with the FCA on driving innovation in financial services.

We believe that our digital transformation platform and synthetic data technology will be a valuable asset in helping fintech companies to develop and test their products more efficiently and effectively.

We look forward to developing the relationship with the FCA and being part of any future focus areas, they have, for development within the industry.