Founded two decades ago, VALID Systems has consistently delivered pioneering risk decisioning solutions to financial institutions and retailers. The introduction of InstantFUNDS seven years ago marked a significant milestone, providing customers access to over $18 billion in check deposit funds ahead of standard schedules. This service has notably eased the challenges some customers face due to traditional funds availability policies. Our ongoing analysis aims to explore the long-term impact on customer behavior, examining factors like attrition, digital adaptation, and overall financial health.

The typical InstantFUNDS customer

Conventional wisdom suggests that quicker fund availability would appeal especially to customers with lower balances, and our data confirms this: the average balance among these customers is $539. A deeper dive reveals that 92% of InstantFUNDS users maintain a balance of $250 or less throughout the month – compared to just 54% in a baseline group of active personal checking accounts. Furthermore, these users predominantly boost their balances via check deposits, responsible for 70% of their account increases compared to 33% in the baseline population.

$539

Average account balance

92%

InstantFUNDS Account Holders with

$250 or less minimum account balance

70%

Account balance increases from check deposits

The baseline population is made up of personal, checking accounts with 10 or more day to day account balance changes in a month (to ensure the accounts are active).

Attrition analysis

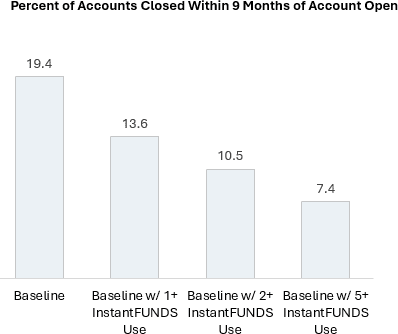

Attrition, or account closure, often signals unmet financial needs. For many InstantFUNDS users, each dollar is critical, and any delay in fund access can lead to frustration. Our study shows that even a single use of InstantFUNDS reduces the likelihood of account closure by 30% relative to the baseline. More frequent use correlates with even lower attrition rates; five or more uses reduce closure rates to 7.4%, a 62% decrease from the baseline.

30%

Less attrition with InstantFUNDS usage

62%

Less attrition with >= 5 InstantFUNDS usage

Baseline Population: Accounts opened in Q4 of 2023 with the following criteria met in their first 3 full months from account open.

- >= 25 day-to-day account balance changes (to ensure the accounts are active)

- >= $1,500 of balance increases (to ensure the account was being funded)

- <= $750 monthly average balance (all months had to be below)

Digital migration analysis

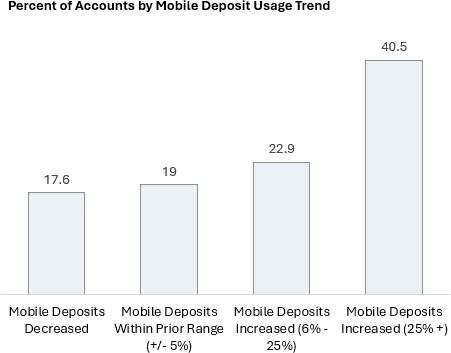

Investments in digital banking technologies not only yield operational efficiencies for financial institutions but also enhance user experience. Our findings indicate that after their initial use of InstantFUNDS, account holders significantly increase their use of mobile banking services, with 63% of them boosting their mobile deposit activities by at least 6%.

63%

Accounts increased their mobile usage by >= 6%

41%

Accounts increased their mobile usage by >= 25%

Population: Accounts opened at least 6 months before their first InstantFUNDS use with >= 5 branch deposits.

Financial health

For account holders with lower balances, managing financial health can be challenging. InstantFUNDS aids in mitigating overdraft fees and provides timely access to funds, which is crucial for these customers. Post-usage analysis shows a marked decrease in overdraft occurrences, with 66% of users reducing their overdraft activities by at least 6%.

66%

Accounts decreased their overdraft items by

>= 6%

36%

Accounts decreased their overdraft items by

>= 50%

Population: Accounts opened at least 6 months before their first InstantFUNDS use

Conclusion

VALID Systems comprehensive analyses affirm the substantial benefits that InstantFUNDS offers to both financial institutions and their customers. By facilitating quicker access to funds, InstantFUNDS helps decrease attrition, fosters digital engagement, and enhances financial stability. As the banking sector continues to evolve, products like InstantFUNDS are crucial for building enduring customer loyalty and supporting financial health.

Stay ahead of the curve with VALID Systems

Subscribe to VALID’s newsletter for exclusive updates and the latest innovations in AI-powered fraud prevention and risk management.