Director, Jonathan Middleton

Financial Services

An educated guess might lead you to believe that a Central Bank Digital Currency (CBDC) is an invention of recent times; however, history reveals that the very first “CBDC” project was initiated as early as 1993 in Finland with Project Avant that set out to build a single national electronic purse system. The project failed and was sold to commercial banks but it did sow the seeds for Central Bank-led payments innovation for the masses.

Fast forward to 2014, Uruguay was the first country to kick off its CBDC experimentation with the e-Peso. In 2015, the Bank of England was another first-mover that began research into digital currencies. What followed was a ripple effect of more and more Central Banks rising to attention and launching their exploratory projects in this space.

Why Central Bank Digital Currencies (CBDC) and why now?

While the drivers behind launching CBDCs can vary as per the country and utility, some of the common denominators include the potential threat from private (or decentralised) digital currencies, limitations and complexity of existing payment systems—both domestic and international, and the need to improve financial inclusion. These factors along with the very human fear of missing out have driven Central Banks from every major country across the globe to figure out their CBDC strategy.

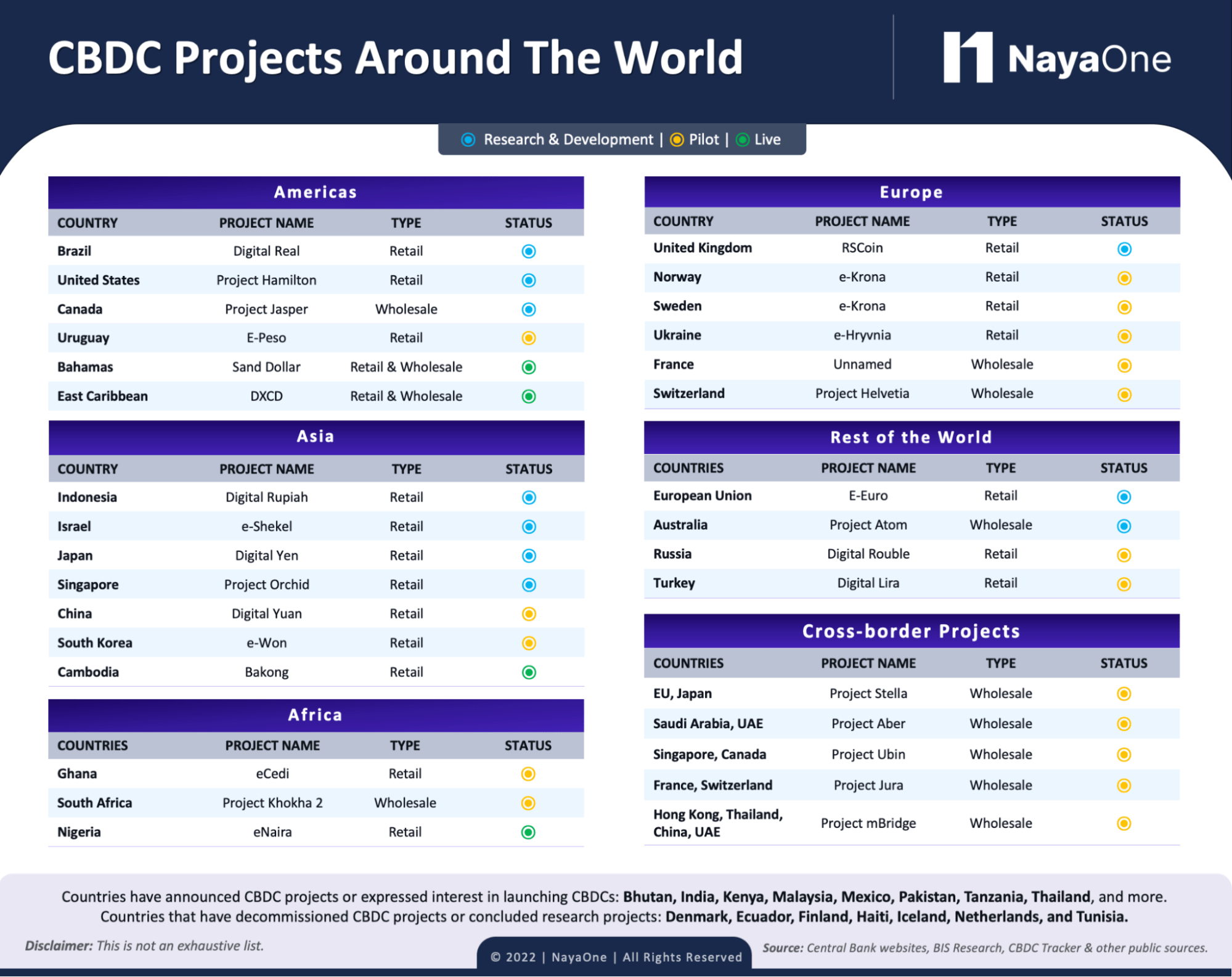

Akin to physical cash or e-money, CBDCs have a plethora of utilities that can be largely classified into retail (for the general public) and wholesale (for institutional use). Countries like China, the Bahamas, and Nigeria, and regional collectives like the East Caribbean have been pioneers in the implementation of retail CBDCs. Developing and emerging economies are especially testing retail CBDCs due to the systemic efficiencies brought about by them. There have also been instances of retail CBDC projects in mature economies like Denmark, the Netherlands, and Iceland that have concluded no present need for digital currencies in their markets. This establishes the fact that CBDCs are not a one-purpose-fits-all solution, but more of a need-based one.

On the contrary, numerous Central Banks have also been testing various wholesale applications of digital currencies for domestic interbank as well as cross-border interbank settlements. Canada’s Project Jasper and Singapore’s Project Ubin, which both began as wholesale domestic CBDC research projects, eventually collaborated for later-stage testing of cross-border transactions and have published several phase-based findings. Similarly, various inter-country collaborations such as Project Stella between the European Central Bank and Bank of Japan, Project Aber involving the central banks of Saudi and the UAE, Project Jura bridging France and Switzerland, and Project mCBDC Bridge involving central banks of Hong Kong, Thailand, China, and the UAE along with the Bank of International Settlements (BIS) are all experimenting with various models of cross-border settlements across their respective systems and currencies to enable smooth and secure operations.

Get Set, Experiment

CBDCs are set to revolutionise the payment landscape with their promising potential. The research, development, and experimentation of Central Bank technologies are paving the way for innovation in financial services. This is something that aligns perfectly with our mission at NayaOne — to help financial institutions build better products and services.

With an increasing number of Central Banks joining the arena to explore the winning use cases of CBDCs, what is important more than ever is to create the right tools, solutions, and platforms to develop and experiment with proof of concepts and pilot trials. The NayaOne platform is built to power such novel experimentations and trials. It enables interoperability between jurisdictions, digital ledgers, and technical suites that can suit the requirements of Central Banks and commercial financial institutions alike.