Strategic Differentiation for AI in Banking

Artificial Intelligence is no longer experimental in banking – it’s operational. But while terms like automation, workflow orchestration, and AI agents are used often, they represent fundamentally different design philosophies, capabilities, and risks.

Understanding the differences is critical to making informed investment decisions, building scalable infrastructure, and meeting evolving customer and regulatory expectations.

1. AI Automation

Operational Efficiency through Narrow Intelligence

What It Is:

AI automation focuses on discrete, rule-based tasks where outcomes are clearly defined. These systems are built to replace or accelerate repetitive human activity – typically within a single department or application.

Unlike traditional scripting or macros, AI-powered automation may use machine learning or NLP to handle variation, but it does not “think” beyond its specific scope.

Strategic Role in Banking:

- Loan Document Processing: AI systems can extract structured data (e.g., income, property value, credit score) from unstructured formats such as scanned PDFs.

- AML Compliance: AI scans transactions in real-time to detect sanction matches or flagged behaviour, automatically triggering alerts.

- Back Office Operations: Reconciliation tasks, inter-system data transfers, and report generation are completed with minimal oversight.

Value Delivered:

- Cost Reduction: Reduces full-time employee (FTE) dependency in high-volume processes.

- Operational Consistency: Low variance in outcomes improves auditability and regulatory trust.

- Speed to Scale: Once deployed, bots can process thousands of items with no increase in marginal cost.

Strategic Considerations:

- Works best in low-variance, high-volume environments.

- Offers a quick win but limited strategic upside unless integrated into broader processes.

- Needs a robust exception-handling strategy – automation fails quietly when faced with edge cases.

2. AI Workflows

Connecting Intelligence Across Functions

What It Is:

AI workflows coordinate multiple steps, systems, and stakeholders to automate an entire process, not just a task. These systems link AI models, business logic, human approvals, and third-party data to deliver outcomes that span multiple functions.

Think of it as a process architecture – with built-in intelligence and adaptability.

Strategic Role in Banking:

- End-to-End Client Onboarding:

Document intake → Biometric verification → Risk scoring → Credit bureau check → Conditional approval → Account creation

- Dispute Management:

Complaint intake → Sentiment analysis → Transaction validation → Eligibility rules → Decision routing → Resolution trigger

- Trade Surveillance:

Pattern detection → Trade clustering → Analyst prioritization → Escalation → Regulatory reporting

Value Delivered:

- Process Transparency: Improves traceability, SLA management, and audit-readiness.

- Customer Experience: Accelerates time to “yes” and reduces onboarding friction.

- Cross-functional Efficiency: Consolidates decision-making across siloed teams.

Strategic Considerations:

- Governance complexity: Multiple systems and rulesets require cross-functional ownership.

- Risk surface area increases if hand-offs or models fail silently.

Best used when end-to-end accountability is critical – e.g., regulated decision-making.

3. AI Agents

Dynamic, Goal-Oriented Decision Engines

What It Is:

AI agents are adaptive systems capable of reasoning toward a goal. Unlike automations or workflows, agents can initiate tasks, choose among options, and revise strategies based on context. Many are powered by large language models (LLMs) or multi-agent frameworks.

They’re not just reacting – they’re deciding.

Strategic Role in Banking:

- Personalised Financial Advising:

Agents can analyse customer data, simulate financial futures, and recommend personalized strategies – automating what relationship managers do for high-net-worth clients. - Conversational Service Assistants:

Instead of simple chatbots, agents can escalate cases, query internal knowledge bases, and suggest proactive actions. - Internal Risk Agents:

Agents can monitor real-time financial exposure and adjust hedging strategies or liquidity preferences autonomously.

Value Delivered:

- Customer Differentiation: Feels like white-glove service at scale.

- Intelligence in Motion: Agents improve over time by incorporating new data.

- Revenue Enablement: Supports cross-sell, up-sell, and customer lifetime value initiatives.

Strategic Considerations:

- High governance load: Risk of hallucination, privacy breaches, or model drift must be actively managed.

- Alignment risk: Agents may optimise the wrong metric if poorly scoped or ungoverned.

- Emerging best practices: Regulatory frameworks for AI agents are still evolving – expect more scrutiny.

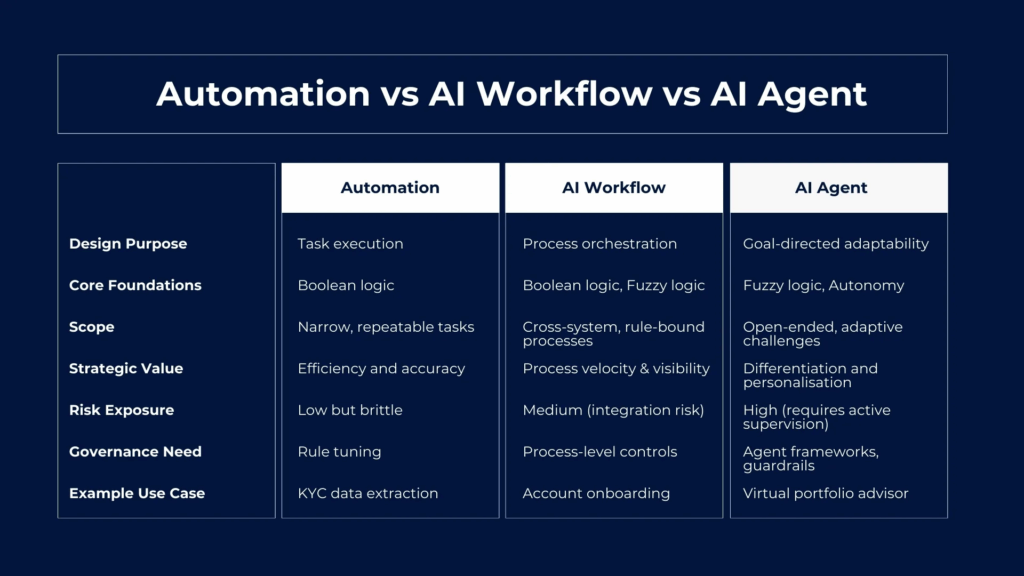

Executive Comparison: Choosing the Right Model (Table) – use image here that has been supplied

Final Take: An Integrated Approach

Forward-thinking banks won’t pick one over the other. Instead, they will:

- Deploy automation to eliminate repetitive cost centres

- Use workflows to reimagine customer journeys and internal coordination

- Introduce agents to drive personalisation, adaptability, and decision-making at the edge

The real challenge isn’t selecting which approach to use – it’s building a flexible innovation capability to test, validate, and deploy each where it delivers the most strategic value.

Where NayaOne Fits In

This is exactly where NayaOne delivers strategic advantage enabling financial institutions and large enterprises to:

- Rapidly test AI solutions – automation tools, workflow orchestrators, or agent frameworks – against synthetic data

- Evaluate multiple vendors and technologies in parallel without the burden of internal integration

- Run controlled, real-time experiments in an independent sandbox to validate risk, compliance, and performance outcomes

- Seamlessly progress from proof-of-concept to production, backed by compliance-ready tooling and audit trails

Whether you’re benchmarking a document-processing automation tool, orchestrating an onboarding workflow, or piloting a generative AI agent – NayaOne helps you do it faster, safer, and smarter.

Next Steps

If you’re exploring how to implement or scale AI – across automation, workflows, or agents – NayaOne can help you design and execute a full test strategy in weeks, not months.

Let’s connect and define your AI sandbox strategy.