Kris Dickinson

Director, Financial Services

Project

Four Central Banks in Africa explored ways to share data to enable greater access to finance and promote COVID-19 recovery through the RecovTech (Recovery Technology) TechSprint.

RecovTech involved a two week “TechSprint” to discuss and develop prototype solutions that enable financial innovation by removing regulatory barriers for fintech companies and institutions. The event brought together regulators & Central Banks from Kenya, Nigeria, South Africa and Egypt, Microsoft, Cambridge University as well as representatives from policy makers, commercial banks, Fintechs and Data Service providers. The audience is intentionally wide to encourage cognitive diversity.

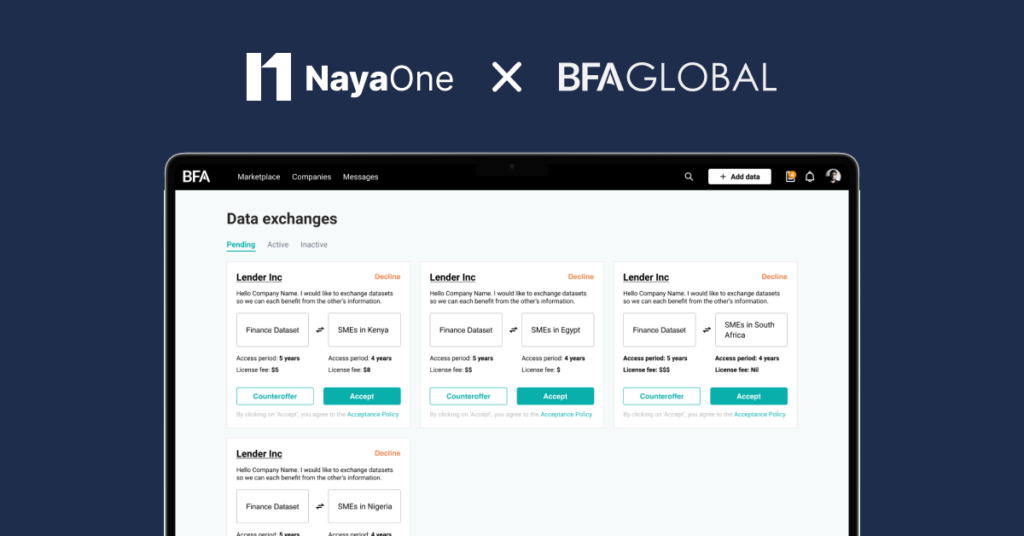

The task was to co-design a data sharing platform to address international “data silos” and identify key “data deserts” where data is not available on key demographics of the population.

NayaOne enabled this collaboration through its Digital Transformation Platform, bringing expertise in data sharing between organisations. The Company’s contribution is part of the wider RecovTech program, funded by the Cambridge Centre for Alternative Finance (CCAF) & the UK Foreign, Commonwealth and Development Office (FDCO) and implemented by BFA Global.

Data in the Sprint

The first sprint focused on an open data platform to source Mid-Size Enterprise market data from the participant countries. Meaningful data could then be used to support lending and policy-making. Sprint Two focused on frameworks to support data sharing between nations, before investigating Privacy Enhancing Technologies (PET), such as synthetic data generation. Synthetic Data maintains the statistical properties of sensitive data allowing it to be used in test environments, such as Digital Sandbox, to test and validate new tools and approaches.

The sprints took place using Fintech Sandpit’s innovation platform, which enables the participants to collaborate and share data together between nations securely. This is a first for the continent to build out and manage their digital ecosystem using real-time messaging, an API Marketplace, and a Data Sandbox.

Why Now?

TechSprint came soon after the release of Consumer Data Protection laws in Egypt, South Africa, Nigeria and Kenya in the last two years, paving the way for closer collaboration between regulators and technology service providers throughout the development process. The solutions created in the TechSprints were presented at the Africa Fintech Festival in mid-October. The Proof-of-Concept solutions will continue to be developed.

This type of collaboration is necessary and fundamental to support fast and robust recovery for low to middle income countries.

Solutions from one nation inspire solutions in another; and data is the fundamental link to facilitate solutions that address the acute problems. Bringing regulators into the creative process ensures firstly, that the solutions will meet the upcoming policy frameworks, and second that regulators are more informed of the technologies where their policies will be applied to.

BFA Global also manages the global inclusive tech accelerator Catalyst Fund, supported by JP Morgan Chase & Co. and the UK Foreign, Commonwealth and Development Office (FCDO).

More than $22M has been invested in Catalyst Fund thus far, and its portfolio of 45 companies have gone on to raise over $126M in follow-on funding.

Its flagship inclusive fintech program is focused on innovators in Kenya, Nigeria, South Africa, Mexico and India who are building inclusive fintech solutions.

Find out more about the Recov TechSprint.

For more information on how we can help your organisation innovate faster, please get in touch with kris@nayaone.com.

About BFA

BFA Global is a research, advisory, data analytics and product innovation firm focused on the intersection of finance, data and technology. The team works with the world’s leading tech innovators, development organizations, policymakers, financial service providers (FSPs) and more to help build solutions that can contribute to more sustainable and inclusive economies. Founded in 2006 by David Porteous, BFA Global is headquartered in Boston and Nairobi, with additional offices in Medellín and New Delhi and a presence in Johannesburg, Lagos, Accra, Madrid, Mexico City and Paris. Today our flagship projects include Catalyst Fund and Finnsalud. Learn more at bfaglobal.com.