<span data-metadata=""><span data-metadata=""><span data-buffer="">Discover the Power of Generative AI in Financial Services

Learn how GenAI is transforming banking, compliance, and customer experience — faster than you think.

<span data-metadata=""><span data-buffer="">What is Generative AI - and Why Now?

Imagine a computer that doesn’t just follow instructions, but actually creates new things. That’s Generative AI! It’s a type of artificial intelligence that can generate text, images, or even data that looks and feels like it was made by a human. Think of it like a really smart artist or writer that can produce unique content on demand.

Why now? Well, recent breakthroughs in computing power and algorithms have made GenAI incredibly powerful and accessible. It’s moving from research labs into our everyday lives, changing how we interact with technology.

Here are a few examples of how it’s being used:

- Chatbots: Providing instant, personalised customer service.

- Fraud Detection: Spotting suspicious patterns and generating realistic simulations of fraudulent activities to improve security.

- Synthetic Data Generation: Creating realistic but artificial datasets for training models and testing systems, especially useful for protecting sensitive financial information.

How GenAI is Already Changing Finance

The future of finance is personal. GenAI is enabling banks and financial institutions to create tailored experiences like never before. From dynamically generated investment portfolios to chatbots that understand individual needs, GenAI is transforming customer interactions. It’s about building trust and loyalty through relevant, timely, and personalised solutions, making financial services more accessible and user-friendly for everyone.

Transforming Risk Management with Predictive Modeling & Synthetic Data

Personalising Customer Experience at Scale for Enhanced Revenue & Loyalty

Automating Regulatory Compliance & Fraud Detection to Reduce Operational Costs & Enhance Security

Real-world GenAI experiments

RISK

DeepFake fraud detection

A large enterprise customer aimed to explore DeepFake prevention technology to detect identity fraud in real-time. They sought to analyse image inputs to identify manipulated media, enhance security, and ensure compliance with industry regulations.

CUSTOMER ENGAGEMENT

Intelligent complaints handling

A banking customer needed a solution to deliver smarter, more efficient customer care, specifically for handling complaints. The challenge involved evaluating different large language models (LLMs) to determine which could best analyse and respond to complaint data effectively while improving customer satisfaction and operational efficiency.

CUSTOMER SERVICE

AI Customer Support

A banking customer aimed to revolutionize their customer service by implementing GenAI-powered virtual assistants. They explored use cases like understanding complex inquiries, generating personalized responses, proactively anticipating customer needs, and providing tailored financial summaries. This allowed for enhanced customer satisfaction through efficient, personalized support, while also streamlining operations and reducing call center load.

DOCUMENT AUTOMATION

Automating document generation

Automated document generation leverages Generative AI, particularly Large Language Models (LLMs), to create tailored documents, reports, and contracts with minimal human intervention. By analysing input data and adhering to pre-defined templates, GenAI can dynamically populate documents, ensuring accuracy and consistency. This technology significantly reduces manual effort, accelerates workflows, and minimises errors across various industries, from legal and financial services to marketing and customer communications. It allows for the rapid creation of personalised, contextually relevant documents, freeing up human resources for more strategic tasks.

PAYMENTS

B2B cross-border payments

A global enterprise faced challenges in managing highly variable cross-border payment compliance due to rapidly changing international regulations. They sought a solution to automate the generation of up-to-date, localised compliance documentation and risk assessments for each transaction. This would enable them to significantly reduce compliance-related delays, minimise the risk of penalties, and provide real-time, transparent compliance reports to their customers.

INSURANCE

Stress-testing underwriting models

An insurance provider sought to enhance its risk assessment capabilities by integrating GenAI to generate highly realistic synthetic data representing diverse customer profiles and potential claim scenarios. Instead of relying solely on historical data, which might not capture extreme or emerging risks, they used GenAI to create a vast, varied dataset of simulated customer behaviours and environmental factors. This allowed them to stress-test their underwriting models against a wider range of potential risks, leading to more accurate predictions, improved fraud detection, and the development of more robust insurance products tailored to evolving market conditions

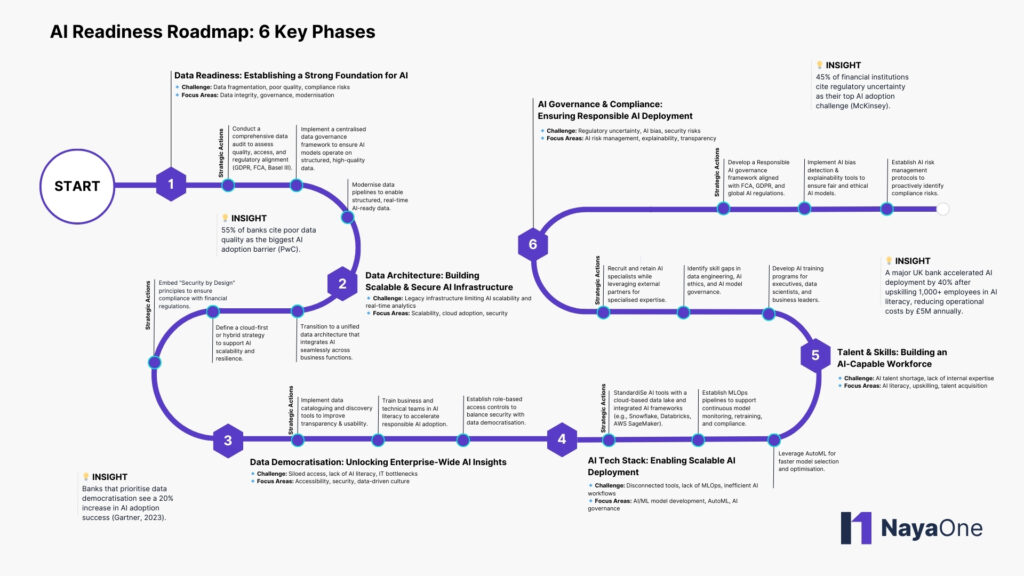

The AI Readiness Roadmap

The future of finance is personal. GenAI is enabling banks and financial institutions to create tailored experiences like never before. From dynamically generated investment portfolios to chatbots that understand individual needs, GenAI is transforming customer interactions. It’s about building trust and loyalty through relevant, timely, and personalised solutions, making financial services more accessible and user-friendly for everyone.

FAQs

In banking, GenAI can automate complex tasks like loan application processing, generate personalised financial advice for customers, enhance fraud detection by creating realistic simulations, and even produce synthetic data for stress-testing portfolios. It’s about automating and personalising key banking operations.

GenAI allows banks to create hyper-personalised customer interactions. Imagine chatbots that understand complex financial queries, generate tailored investment suggestions, or provide instant, personalised loan offers. It’s about delivering a seamless, individualised experience at scale.

GenAI can generate realistic synthetic data to train fraud detection models, enabling banks to identify and prevent fraudulent activities more effectively. It can also analyse vast datasets to detect anomalies and patterns that indicate potential fraud, strengthening the bank’s security posture.

GenAI can automate the analysis of complex regulatory documents and generate reports, reducing the time and cost associated with compliance. It can help banks stay ahead of evolving regulations and minimize the risk of non-compliance.

Banks must address risks like data privacy, bias in generated content, and the potential for misuse. Robust governance, ethical guidelines, and thorough testing are essential. Platforms like NayaOne can help banks navigate these challenges by providing vetted GenAI solutions and expert support.

Nayaone’s independent sandbox is a secure, isolated environment where financial institutions can test and experiment with cutting-edge AI solutions, including Generative AI models. It allows you to explore GenAI capabilities without impacting your live systems, providing a safe space for innovation.

Nayaone’s sandbox provides a pre-configured, ready-to-use environment, saving you significant time and resources. We curate and integrate vetted GenAI solutions, handle infrastructure complexities, and offer expert support, allowing you to focus on developing your use cases.

You can test a wide range of GenAI applications, including:

- Personalised customer service powered by LLMs.

- Fraud detection using synthetic data generation.

- Automated report generation and compliance analysis.

- Content creation for marketing and customer communications.

- Risk modelling and scenario simulation.

Security is paramount. Our sandbox is designed with robust security measures, including data encryption, access controls, and compliance with industry standards. We prioritise data privacy and ensure that your sensitive information is protected throughout the experimentation process.

NayaOne provides access to pre-vetted AI solutions, and helps banks to understand the regulations surrounding the use of AI. NayaOne can help banks to mitigate risks, and ensure responsible AI deployments