- Whitepaper

Maximising Data Value: A GenAI Framework for CIOs and CDOs

A Message to C-Suite Leaders

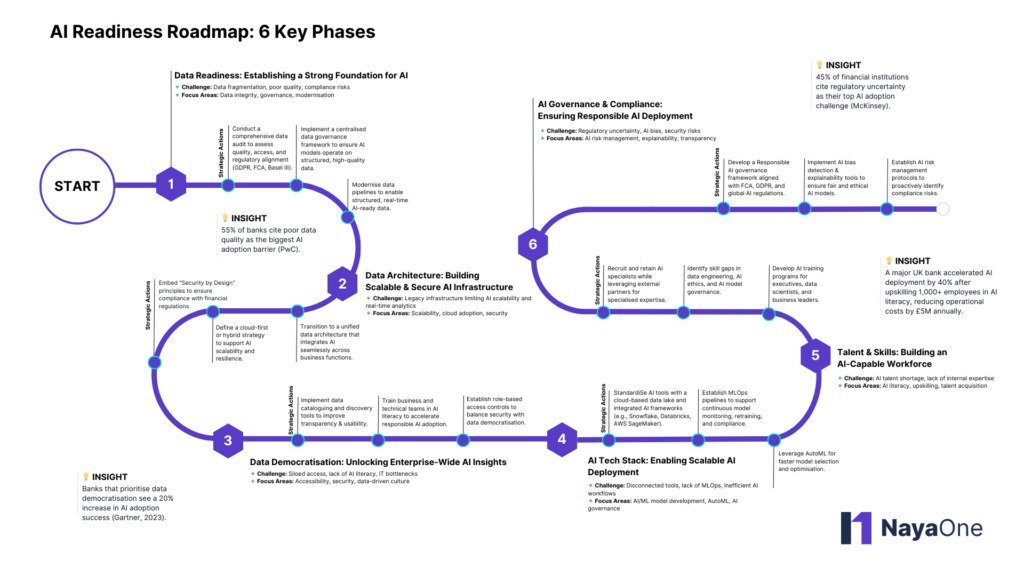

As banking executives, you are tasked with steering your institution through an era of unprecedented technological transformation. The emergence of Generative AI (GenAI) presents an opportunity not only to enhance efficiency but to fundamentally reshape the way financial institutions operate. However, success is not guaranteed – realising AI’s full potential requires a strategic approach to data readiness, architecture, governance, and talent.

Executive Summary

Data is the lifeblood of modern banking, and Generative AI (GenAI) presents an unprecedented opportunity to unlock its full potential. However, the real challenge for CIOs and CDOs lies in preparing their data, architecture, and teams to leverage AI effectively.

This whitepaper is designed to help CIOs and CDOs navigate the complexities of AI adoption, equipping them with the insights and frameworks needed to unlock the true value of their data assets.

Key questions addressed include:

- Is our data setup AI ready?

- Do we have the right data architecture to support GenAI?

- How accessible is our data to business, technology as well as specific AI teams within them?

- Are our data tools and tech stack aligned with our AI ambitions?

- Do we have the right talent to extract value from our data?

- What decisions do we need to make to maximise ROI from AI initiatives?

- Which teams within the bank would benefit most from AI support, and how should we prioritise them?

A recent McKinsey report found that banks that effectively leverage AI could achieve a 10 - 15% increase in annual growth.

1. Navigating AI Adoption Challenges: Key Barriers for CIOs and CDOs

As financial institutions accelerate their digital transformation, CIOs and CDOs are under increasing pressure to harness AI for strategic advantage. However, AI adoption is not simply a technology upgrade – it requires overcoming entrenched data fragmentation, regulatory uncertainty, talent shortages, and integration complexities. Legacy systems often lack the agility to support AI-driven insights, while evolving compliance requirements demand transparency and explainability. Additionally, the scarcity of AI talent poses a major roadblock to execution. To realise the full potential of AI and drive tangible business outcomes, banking leaders must address these challenges with a structured, scalable, and risk-aware approach.

These challenges become particularly evident when assessing data readiness. Many financial institutions grapple with inconsistent, siloed, and incomplete data. Without a strong foundation in data management and governance, AI models can produce unreliable outputs, leading to misinformed business decisions. Additionally, ensuring regulatory compliance while making data AI-ready remains a pressing concern for CIOs and CDOs. Addressing these barriers is the first critical step towards unlocking AI’s potential.

2. Assessing Data Readiness: Is Your Data AI-Ready?

AI adoption success depends on how well an institution prepares its data landscape. Without structured, clean, and accessible data, AI models will struggle to generate meaningful insights, leading to poor decision-making and compliance risks. CIOs and CDOs must tackle data silos, quality inconsistencies, and security constraints before AI deployment can scale effectively.

- Key Considerations: Integrity, governance and modernisation.

Key Challenges in Data Readiness:

- Data Fragmentation: Disparate systems and isolated data repositories create inefficiencies and hinder AI-driven insights.

- Regulatory Compliance: Maintaining GDPR, FCA, and Basel III requirements while ensuring AI-generated decisions remain auditable.

- Scalability Issues: Legacy systems may lack the flexibility to support AI-driven analytics and real-time processing.

Key Questions:

- Is our data structured, clean, and available in real-time?

- Which teams in the bank should we prioritise for AI-driven data consolidation, ensuring secure, role-based access and scalability?

- Are our data pipelines designed for scalability and agility?

Strategic Recommendations:

- Data Audits: A data audit should be tackled in phases, starting with inventorying and classifying key data sources, assessing quality, and ensuring governance and compliance. This is followed by analysing access and usage patterns and evaluating integration readiness, allowing for a manageable, structured approach to data consolidation.

- Governance Framework: Implement a robust data governance model to maintain quality, privacy, and regulatory compliance.

- Goal Architecture: Define a scalable and adaptable architecture that supports data consolidation, role-based access, and AI-driven innovation.

- Real-world use case: A leading retail bank struggled with fragmented data, leading to inaccurate credit risk assessments and weak fraud detection. By conducting a data audit and implementing an AI-driven governance framework, the bank improved credit risk accuracy by 30%, reduced fraud losses by 40%, and enhanced regulatory compliance. This transformation strengthened risk management, optimised lending decisions, and positioned the bank for AI-driven innovation.

According to a recent PwC report, 55% of banks struggle with data quality issues that hinder AI adoption. Moreover, only 24% of banking execs feel their data is fully AI-ready.

3. Building the Right Data Architecture

A robust data architecture is the backbone of an AI-driven bank. Without the right architecture, financial institutions may face significant bottlenecks, security vulnerabilities, and operational inefficiencies. Modernising infrastructure to support real-time data flows and AI applications is a key priority for CIOs and CDOs aiming to stay ahead of the competition.

- Key Considerations: Scalability, real-time processing and security.

Key Questions:

- Does our architecture support real-time data processing for AI applications?

- Are we leveraging cloud, on-prem, or hybrid solutions effectively?

- Do we have the right tools for data ingestion, transformation, and analysis?

Strategic Recommendations:

- Unified Data Platform: Adopt an enterprise-wide data architecture to enable seamless AI integration.

- Cloud Adoption Strategy: Assess the benefits of cloud solutions for AI scalability.

- Security by Design: Embed compliance and security controls within the architecture.

- Real-world use case: An investment bank faced bottlenecks in AI processing due to outdated, on-premise systems. After adopting a cloud-first data architecture, the bank reduced processing time for AI-driven trade analytics by 40% and enhanced real-time fraud detection, saving millions in potential fraud losses annually.

4. Data Democratisation: Unlocking Enterprise-Wide Insights

Data democratisation is essential for enabling teams across the bank to access, analyse, and leverage data without IT bottlenecks. Providing secure, self-service access to data empowers employees to make data-driven decisions, fostering innovation and improving customer experiences. CIOs and CDOs must find the right balance between accessibility and governance to unlock AI’s potential responsibly.

- Key Considerations: Accessibility, security and culture.

Key Questions:

- How accessible is our data to business and AI teams?

- Are we fostering a data-driven culture across the organisation?

- How do we enable self-service analytics and AI experimentation?

Strategic Recommendations:

- Data Cataloguing: Implement data discovery and cataloguing tools to improve accessibility.

- Education and Training: Upskill employees to be come data-literate and AI-aware.

Role-Based Access: Ensure secure, role-based access to data to balance control with innovation while ensuring data is available, timely, and auditable, with clear tracking of access and usage.

- Real-world use case: A wealth management firm struggled with slow, manual data access for financial advisors, limiting customer insights. By implementing self-service AI-powered dashboards, advisors reduced client query resolution time by 50%, leading to improved customer retention and engagement.

Fact: Banks that prioritise data democratisation see a 20% increase in AI adoption success rates (Gartner, 2023). However, a survey by EY indicates that only 30% of banks have established comprehensive data democratisation initiatives.

5. Tools and Technology Stack: Enabling Scalable AI Deployment

AI’s transformative potential in financial services hinges on having the right tools, infrastructure, and frameworks to support scalable and efficient AI/ML model development. The ability to build, deploy, and manage AI models seamlessly requires a modern, well-integrated tech stack that enables automation, real-time data processing, and continuous model optimisation. Organisations must assess whether their existing technology ecosystem aligns with their AI goals or if gaps in AutoML, MLOps, and AI/ML model development are slowing innovation.

- Key Considerations: AI/ML model development, AutoML, and MLOps capabilities.

Key Questions:

- Does our tech stack enable AI/ML model development?

- Do we have MLOps in place for continuous monitoring, retraining, and governance?

- Are we leveraging cloud, on-prem, or hybrid solutions effectively?

- Do we have the right tools for data ingestion, transformation, and analysis?

Strategic Recommendations:

- Ensure compatibility between data platforms and AI tools.

- Ensure that cloud, on-prem, or hybrid environments are optimised for AI workloads, with high-performance computing (HPC) and GPU acceleration where needed.

- Leverage AutoML tools to automate feature engineering, model selection, and hyperparameter tuning to reduce time-to-value for AI models.

- Establish end-to-end model lifecycle management with continuous integration/continuous deployment (CI/CD), version control, and automated retraining for AI systems.

- AI models must be interoperable with existing applications, APIs, and workflows, enabling real-time decision-making and enhanced customer experiences.

- Establish AI performance tracking, bias detection, and explainability measures to ensure responsible and effective AI adoption.

- Real-world use case: A large multinational bank faced significant delays in AI deployment due to fragmented technology stacks across regions. Siloed departments used disparate data management tools, causing inconsistencies in model performance and security risks. To address this, the bank invested in data engineering, standardising its AI tech stack with a unified cloud-based data lake, automated MLOps pipelines, and AI model governance tools. Leveraging Snowflake for centralised storage, Databricks for model development, and AWS SageMaker for AI deployment, the bank improved AI execution speed by 45% while ensuring regulatory compliance across all regions.

6. Talent and Skill Readiness: Building an AI-Ready Workforce

While AI presents tremendous opportunities, banks often face a talent shortage that hinders widespread adoption. A skilled workforce is critical for AI success, requiring expertise in data science, AI ethics, and regulatory compliance. Developing internal capabilities and fostering a culture of continuous learning will be vital to long-term success.

- Key Considerations: AI literacy among executives, internal vs external expertise, talent acquisition and retention.

Key Questions:

- Do we have the talent and expertise to effectively leverage AI?

- What skills are needed to operationalize AI at scale, including data engineering, MLOps, and AI governance?

- Should we build internal capabilities or partner with AI vendors for efficiency and scalability?

- How do we distribute AI skills across the business to drive adoption and ensure teams can integrate AI into daily operations?

Strategic Recommendations:

- Build internal AI training programs tailored to leadership and technical teams.

- Identify skill gaps in data science, AI governance, and engineering.

- Recruit and retain data science talent.

- Leverage external AI experts for specialised projects.

-

Real-world use case: A major bank recognised a lack of AI expertise among its employees, which slowed AI project implementation. By running GenAI Immersion sessions led by NayaOne, the bank upskilled over 1,000 employees in AI literacy, accelerating AI deployment across departments. As a result, the bank accelerated AI implementation by 40%, improved data-driven decision-making across teams, and reduced dependency on external consultants - saving an estimated £5 million in annual operational costs.

In comparison, many banks struggle to scale AI technologies across their organisations due to fragmented data assets and outdated operating models. These challenges often lead to significant delays and cost overruns in technology transformation efforts. (McKinsey). By investing in internal AI expertise, the bank not only expedited its AI initiatives but also mitigated common pitfalls associated with large-scale technology implementations.

7. Strategic Decisions

As AI continues to redefine financial services, organisations must make critical strategic decisions today to ensure they remain competitive and future-proof their AI investments. Success in AI-driven transformation isn’t just about technology – it’s about aligning AI adoption with business objectives, regulatory requirements, and long-term scalability. Leaders must prioritise decisions that drive ROI, mitigate risk, and accelerate AI adoption while ensuring compliance and ethical considerations are at the forefront.

- Key Considerations: AI governance, ethical AI, regulatory alignment, investment priorities, and scalability.

Key Questions:

- What are our AI investment priorities, and how do they align with our business goals?

- How do we ensure AI adoption meets regulatory and compliance requirements?

- What governance frameworks are in place to manage AI ethics, bias, and transparency?

- How do we balance short-term AI wins with long-term scalability and sustainability?

- Are we fostering a culture of AI-driven innovation and cross-functional collaboration?

Strategic Recommendations:

- Establish a long-term AI roadmap that aligns with business goals, prioritises high-impact use cases, and ensures scalable adoption over time. Commit to a strategic investment horizon (e.g., three years) with continuous iteration and refinement.

- Develop policies for ethical AI, regulatory adherence, and responsible AI usage to mitigate risks and build trust in AI-driven decision-making.

- Foster an AI-driven culture by upskilling teams, embedding AI into core processes, and promoting cross-functional collaboration.

- Define clear KPIs and OKRs to measure progress, ensuring AI investments deliver tangible value while allowing for adaptive learning and course correction.

- Select AI architectures, tools, and infrastructure that support long-term growth, enabling seamless expansion and adaptation to evolving AI advancements.

8. Real-World Cases Where Financial Institutions are Leveraging GenAI

- Enhanced Customer Service with AI-Powered Chatbots: Banks are deploying GenAI-driven chatbots to provide 24/7 customer support, handling queries from account balances to tailored financial advice. These AI assistants offer context-aware and human-like interactions, improving customer satisfaction.

- Advanced Fraud Detection and Prevention: GenAI enhances fraud detection by analysing large datasets in real time to identify unusual transaction patterns. AI systems help banks proactively prevent fraudulent activities by monitoring behavioural anomalies.

- Personalised Financial Advisory Services: By analysing customer data, GenAI delivers bespoke financial advice, assisting clients with budgeting, investment strategies, and product recommendations. AI can also provide tailored repayment plans based on a borrower’s financial history, strengthening customer relationships.

- Credit Risk Assessment: AI models assess creditworthiness by evaluating transaction history, economic indicators, and non-traditional data sources. This enhances accuracy in lending decisions, reducing default risks and expanding financial inclusion.

- Algorithmic Trading Optimisation: In investment banking, AI algorithms analyse market data, optimise trading strategies, and execute trades at optimal times. This leads to better investment decisions and a competitive edge in financial markets.

- Regulatory Compliance and Reporting: GenAI enhances compliance by automating regulatory reporting, summarising complex regulations, and generating audit-ready documentation while enabling natural language interactions with data. Its ability to generate text, interpret policies, and streamline workflows reduces manual effort and improves accuracy. However, for tasks like credit approvals, loan underwriting, and algorithmic risk assessments, traditional AI models trained on financial data and risk parameters play a more significant role.

9. Case Study: Embedding AI Ethics in Generative AI Solutions

- Background: As banks adopt Generative AI (GenAI), ensuring ethical, transparent, and reliable outputs is essential for compliance and trust. In regulated environments, AI-generated insights must be accurate, verifiable, and aligned with governance standards, addressing challenges like bias, data privacy, explainability, and accountability.

- Challenge: A leading financial institution in the NayaOne ecosystem sought to develop comprehensive AI Ethics framework to ensure AI outputs were ethical, compliant, and reliable. They aimed to tackle issues such as bias, data privacy, transparency, and governance while maintaining regulatory alignment and operational efficiency.

- Approach: The approach involved building a retrieval-augmented generation (RAG) pipeline to enhance output reliability, testing in secure sandbox environments simulating production conditions, and evaluating multiple LLMs (e.g., Gemini, GPTs, LLaMA2) for fairness, compliance, transparency, and data privacy. Ethical auditing frameworks and Explainable AI (XAI) techniques were also integrated to improve governance and accountability.

- Results: The PoC validated a structured approach to AI ethics, ensuring outputs are fair, compliant, and trustworthy for banking use cases. It also provided a strong foundation for developing comprehensive Data and AI Ethics strategies across global operations. Moving forward, the banks will explore additional techniques to enhance ethical AI deployment and broaden GenAI applications.

-

Outcome:

- 25% increase in regulatory-aligned outputs

- 30% improvement in fairness and bias detection

- 70% faster validation of AI outputs through explainability tools

10. Conclusion and Next Steps

Maximising data value with GenAI is no longer optional – it is imperative. CIOs and CDOs must take proactive steps to assess readiness, prioritise high-impact use cases, and establish governance frameworks that ensure AI success.

- Access PDF version

- Book a demo with the NayaOne team to take the next step toward AI-driven innovation.

- Conduct a Readiness Assessment: Identify gaps in data, infrastructure, and skills.

- Leverage Trusted Platforms: Experiment securely with partners like NayaOne.

- Scale AI Capabilities: Develop a roadmap, measure ROI, and integrate AI across teams.