Rachelle Palmer

Growth and Innovations Manager

Finclusion week is a national initiative to tackle financial exclusion across the UK. Leading British firms are reshaping the financial sector, by hosting a series of connected events that develop and incorporate technological disruption within the finance industry.

The NayaOne x Tech Nation Finclusion Hackathon kicked off on the 1st December, with global participants excited to work in teams, with the help of mentors who volunteered their time, to develop a solution using the NayaOne digital sandbox for tackling finclusion challenges, in this case, coping with cancer and preventing premium poverty.

The entire event was hosted through the digital sandbox, where participants had access to APIs and data, to help develop their tech for good innovations.

To start the event, all participants were welcomed by Ravi Shukla, Head of Fintech Delivery Panel at Tech Nation and Keynote Speaker Chris Pond, Chair at Financial Inclusion Committee.

Prior to the hackathon Chris Pond mentioned that “Millions of people are living on the edge, without the safety net of savings or insurance, access to affordable credit — and even sometimes a bank account. FinTech can make a real contribution to challenging financial exclusion, and the poverty premium that goes with it, by designing products and services that meet people’s needs. Get involved in Finclusion 2021 and make a real difference.”

Such shocking statistics are only predicted to get worse, as income decreases and the cost of living soars.

Following Leo’s speech was Martin Coppack, from Fair By Design who is determined to tackle the higher costs associated with being poor.

Data Introductions

The first challenge presented was to create a solution, using the sandbox, to help those who suddenly encountered financial insecurity due to a cancer diagnosis. As people are often confronted with cancer unexpectedly, millions are unable to cope with the huge financial impacts that often occur, from finding themselves unemployed to not having access to affordable credit.

The second challenge was focused on disrupting the insurance industry, which would allow people from lower socio-economic backgrounds to access insurance at the standard market rate, without having to pay a premium, based on where they live which in turn determines their desirability.

Our data scientists at NayaOne, researched publicly available information regarding the statistics for both challenges, and these were provided to the participants as background knowledge on the social issues.

Presentations

As the hackathon progressed, during their available time slots, mentors advised teams on their products and pitches, but also helped them view the problems from a variety of angles.

Furthermore, some mentors actually participated in the hackathon by delivering presentations on pitch sessions, leveraging fintechs, alternative data financial inclusion and the importance of a sustainable solution.

The first presentation delivered by Ben Eisenberg from People Data Labs, discussed the importance of alternative data and its contribution to financial inclusion.

In another pitch, presented by Tom Bull from EY, focused on partnerships as a way to drive innovation within fintech.

Presenter and mentor, Keshav Singh from Natwest, was about the purpose and importance of perfecting a pitch.

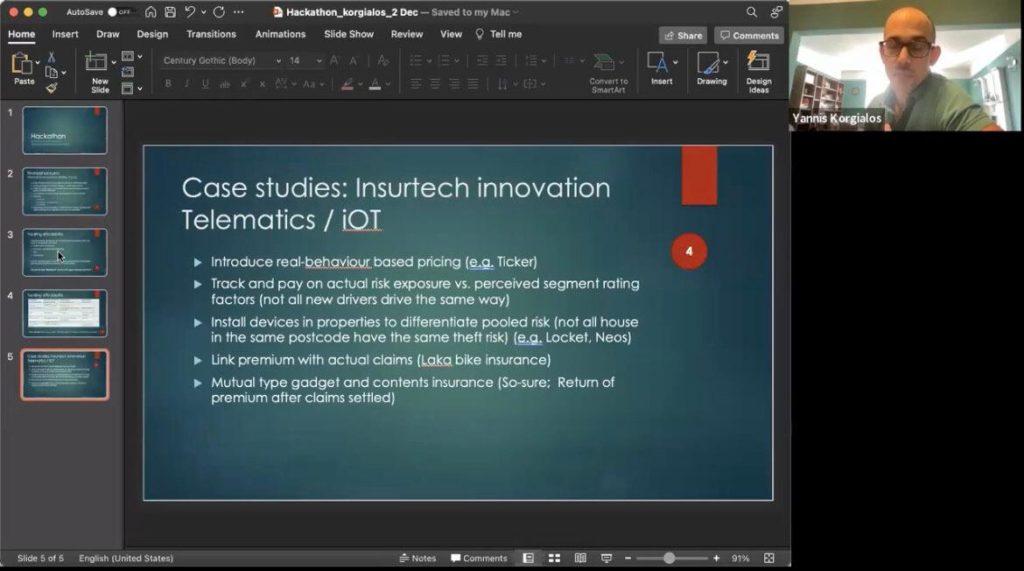

Last but not least, Yannis Korgialos from Ticker, explained the various potential barriers affecting people from lower socio-economic backgrounds are a lack of access and awareness including understanding the product and its necessity, in addition to insurance simply being unaffordable.

With this being said, participants of the hackathon were encouraged to keep these factors in mind when developing a solution.

After 2 days and 4 presentations later, all teams were required to present their pitches to a panel of judges.

To kick off the judging session, everyone was welcomed by Victoria Roberts, Tech Nation and our very own data scientist who ensured that each team had no longer than 4 minutes each to pitch.

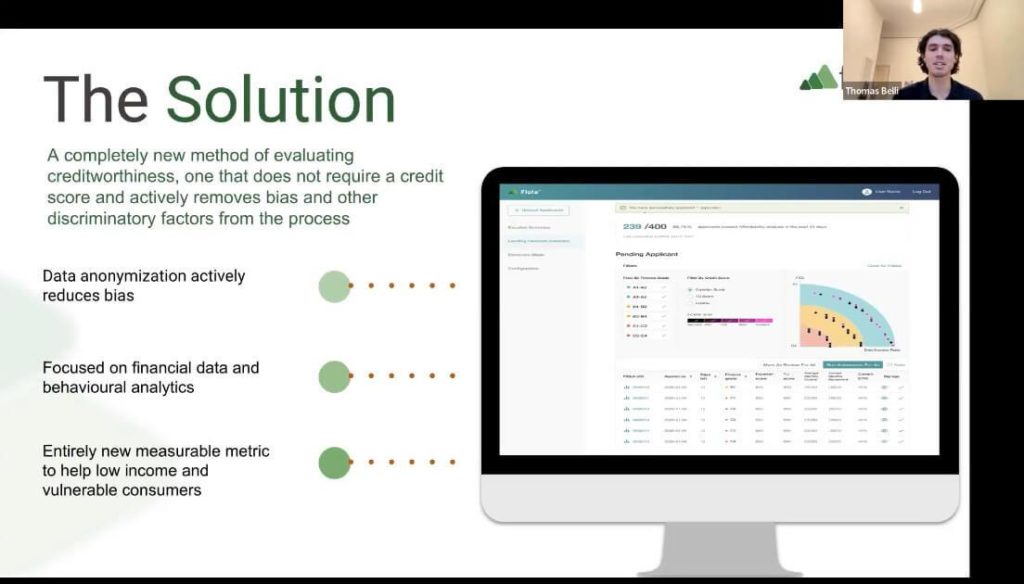

The winners under the team category were Finexos. They presented a completely new method of evaluating credit worthiness, by building an algorithm that relies fully on anonymised data with the solution focusing on financial data by leveraging machine learning, Open Banking data and behavioral indicators. This in turn, allows lenders to predict consumer financial behavior, that is how much they spend, how often they shop and on what they buy.

The individual winner, Anuja Wagh, presented a digital solution that would create and track an individual’s cancer journey through an ecosystem designed to ensure they are adequately supported.

Overall the NayaOne hackathon, as part of Tech Nation’s Finclusion 2021 campaign to encourage tech-enabled solutions to financial exclusion challenges, was a success.

Over the course of 2 days, there were a total of 50 users, across 10 teams, who were actively engaged for the duration of the event. Regarding the final pitches, over 100 people registered to watch. The finclusion message travelled far and wide across the financial ecosystem reaching banks, insurers, fintechs and academia all engaged.

This event was designed to inspire developers to address the financial inequalities of those who find themselves unexpectedly coping with cancer, or those who pay a poverty premium for insurance products.