Across the banking sector, one thing is clear: innovation isn’t the challenge – execution is.

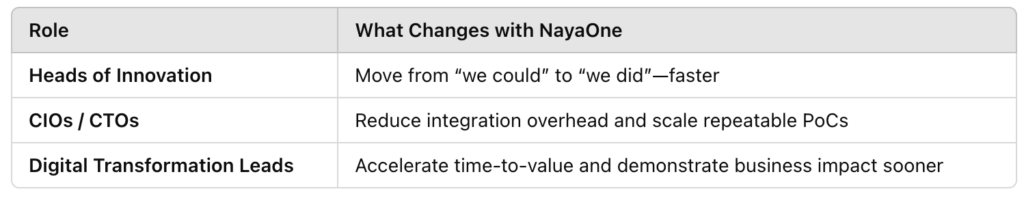

For Heads of Innovation, CIOs, and Digital Transformation leaders, the drive to engage fintechs, run proof-of-concepts, and bring new solutions to market has never been stronger. But traditional processes haven’t kept up.

The good news? That’s slowly changing.

There’s now a faster, more scalable way to move from idea to impact – without compromising governance, security, or risk management.

Why Traditional PoCs Are Ready for a Rethink

Proof of Concepts (PoCs) are essential. They help validate new technology, de-risk implementation, and bring the right partners into your ecosystem. But the way most financial institutions run PoCs today creates friction and delay – especially when vendor onboarding alone can take 6 to 12 months.

That timeline makes it almost impossible to iterate, learn, and adapt at market speed. And with increasing pressure to show impact, there’s a growing demand for rapid prototyping and testing environments that can enable agile, structured experimentation.

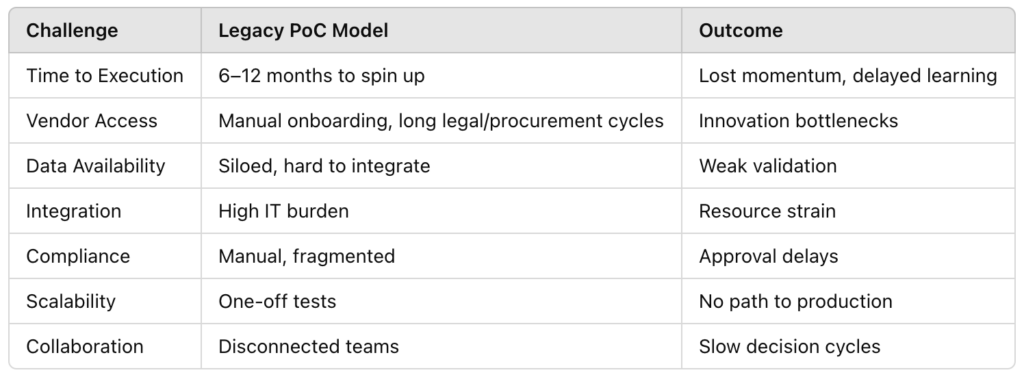

Here’s how the traditional process slows innovation down:

This doesn’t just limit what’s possible – it prevents the business from moving at the pace customers and markets now expect.

The Future is Sandbox-Based, Scalable, and Fast

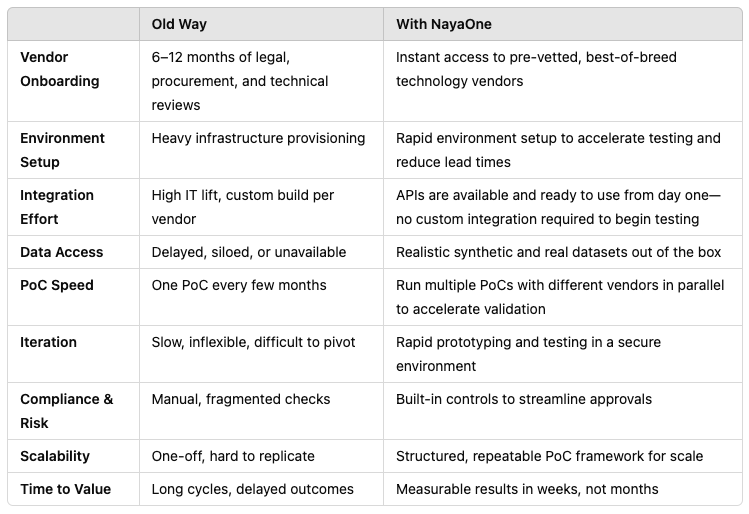

NayaOne was built to change that. Our platform brings together everything you need to run fast, secure, effective PoCs – on demand. No red tape. No heavy infrastructure lift. Just a smarter way to innovate.

Case Study: Tier 1 Bank Turned PoC Into Production - Fast

The Challenge: Launching a digital wallet feature meant navigating months of onboarding, compliance, and infrastructure hurdles. Their PoC cycle averaged 12–18 months.

With NayaOne, they:

- Accessed vendors instantly through our marketplace

- Tested multiple vendors in parallel

- Used realistic synthetic data inside a secure sandbox

- Integrated via plug-and-play APIs

The impact:

- 50% faster time-to-market

- 80% reduction in PoC delivery costs

- 90% shorter PoC cycle

- 20% growth in customer digital wallet adoption in Q1

It’s what happens when innovation teams are enabled to move at speed – not held back by legacy timelines.

Designed for the People Driving Change

The Path is Clear - and It's Getting Faster

Slow vendor onboarding, siloed data, and drawn-out integration cycles no longer have to be barriers to innovation.

With NayaOne, banking leaders are turning ideas into outcomes – and doing it in weeks, not months.

If you’re ready to reduce friction, accelerate testing, and deliver real value – let’s get started.