Across the financial sector, one thing is becoming increasingly clear: innovation isn’t the bottleneck. Execution is.

For Heads of Innovation, CIOs, and Digital Transformation leaders, the intent is there – to engage fintechs, validate emerging tech, and bring new solutions to market. But the processes built to support innovation haven’t kept pace with the speed of change.

And that’s where momentum stalls.

PoCs Matter Now More Than Ever - But the Process Needs to Evolve

Proof of Concepts are critical to de-risking innovation. They help validate capabilities, evaluate fit, and align teams. But most institutions are still running PoCs through infrastructure and governance frameworks that weren’t designed for today’s scale or complexity.

The result?

- Vendor onboarding can take 6 – 12 months

- Access to data is delayed or blocked by compliance

- Testing environments are built ad hoc – or don’t exist

- Legal, risk, and IT approvals are slow and disconnected

That timeline isn’t just inconvenient.

It’s incompatible with how fast the market is moving.

And as regulatory pressure increases and board-level visibility on AI and fintech grows, the need to move fast, safely has never been greater.

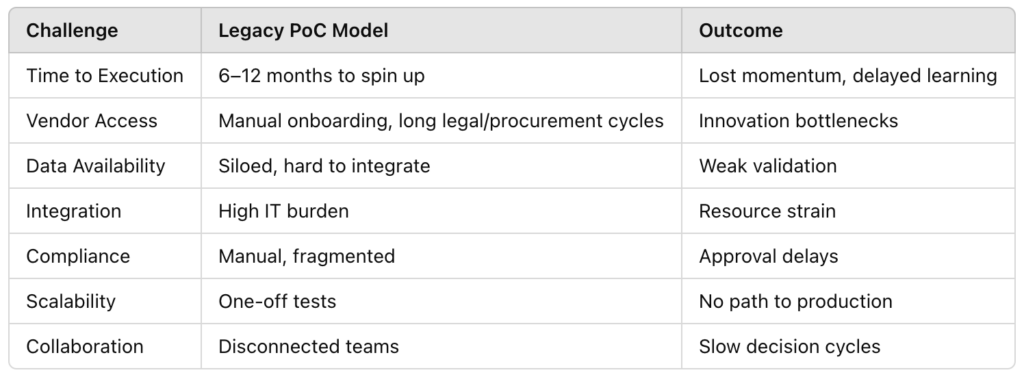

What’s Really Slowing Innovation Down?

This isn’t about moving recklessly. It’s about creating an environment where teams can test quickly, safely, and with the right controls in place from the start.

Where the Industry is Going:

Sandbox-Based, Secure, Scalable

Innovation leaders across banking are rethinking their approach. They’re moving away from one-off experiments – and toward platforms that enable structured, governed, rapid experimentation.

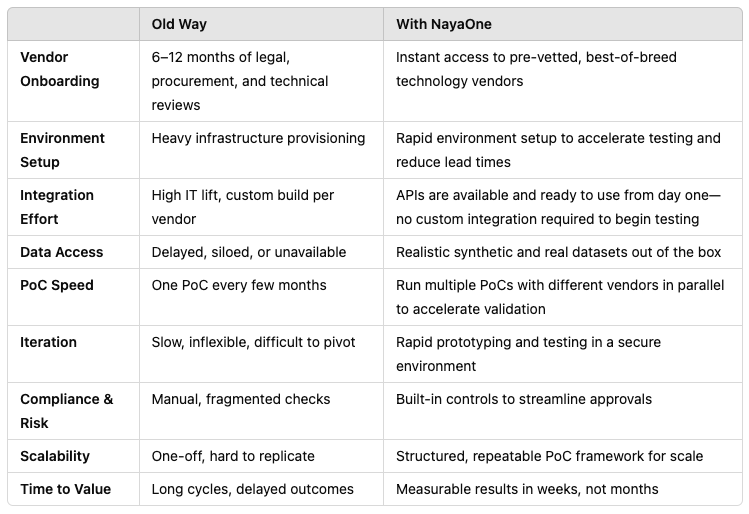

That’s where NayaOne fits in.

We provide a unified environment that brings together:

- Pre-integrated vendors

- Synthetic and anonymised data for safe testing

- Enterprise-grade sandboxes with built-in compliance

- Side-by-side evaluations and vendor benchmarking

- Real-time audit trails, observability, and risk controls

In short: a system that helps banks move from idea to impact, without the typical delays.

The New Path: Faster, Safer, More Aligned

What we’re seeing isn’t a fringe trend – it’s a strategic shift.

The banks moving fastest aren’t skipping steps. They’re redesigning how testing happens so that approvals, oversight, and outcomes can coexist.

The Bottom Line: Speed Alone Isn’t the Goal - Precision Is

Banks actually need more pilots – not fewer.

But they need them to run safely, quickly, and with clear purpose.

Pilots should be fast, structured experiments – not drawn-out projects with no clear path forward.

Institutions need the ability to test more ideas, with more vendors, under real constraints – without adding risk or delay.

That’s what unlocks meaningful innovation at scale.

Ready to Rethink How Innovation Gets Delivered?

Whether you’re looking to evaluate GenAI vendors, test fintech integrations, or bring new ideas to life – you don’t need to start from scratch.

You need an environment built for innovation at enterprise scale.

Let’s talk.