Jonathan Middleton

Director, Financial Services

Physical cash is losing relevance. CBDC, or Central Bank Digital Currency, aims to address the evolving need for efficient and secure solutions.

CBDC is a digital form of currency that a country’s central bank issues. It operates on a blockchain or similar technology.

Unlike cryptocurrencies like Bitcoin, which are decentralised and typically not backed by a central authority, CBDCs are issued and regulated by central banks. This makes them a form of digital fiat currency.

CBDCs strive to provide a secure, efficient, and transparent means of conducting transactions while also allowing central banks to maintain control over the monetary system.

In May 2020, 35 countries were exploring CBDC. This number rose to around 100 countries in 2021.

Meanwhile, three countries have already deployed it: The Bahamas launched the Sand Dollar in October 2020, Nigeria launched the eNaira in October 2021, and Jamaica launched JAM-DEX in April 2022.

Let’s dive deeper into CBDC and its various use cases.

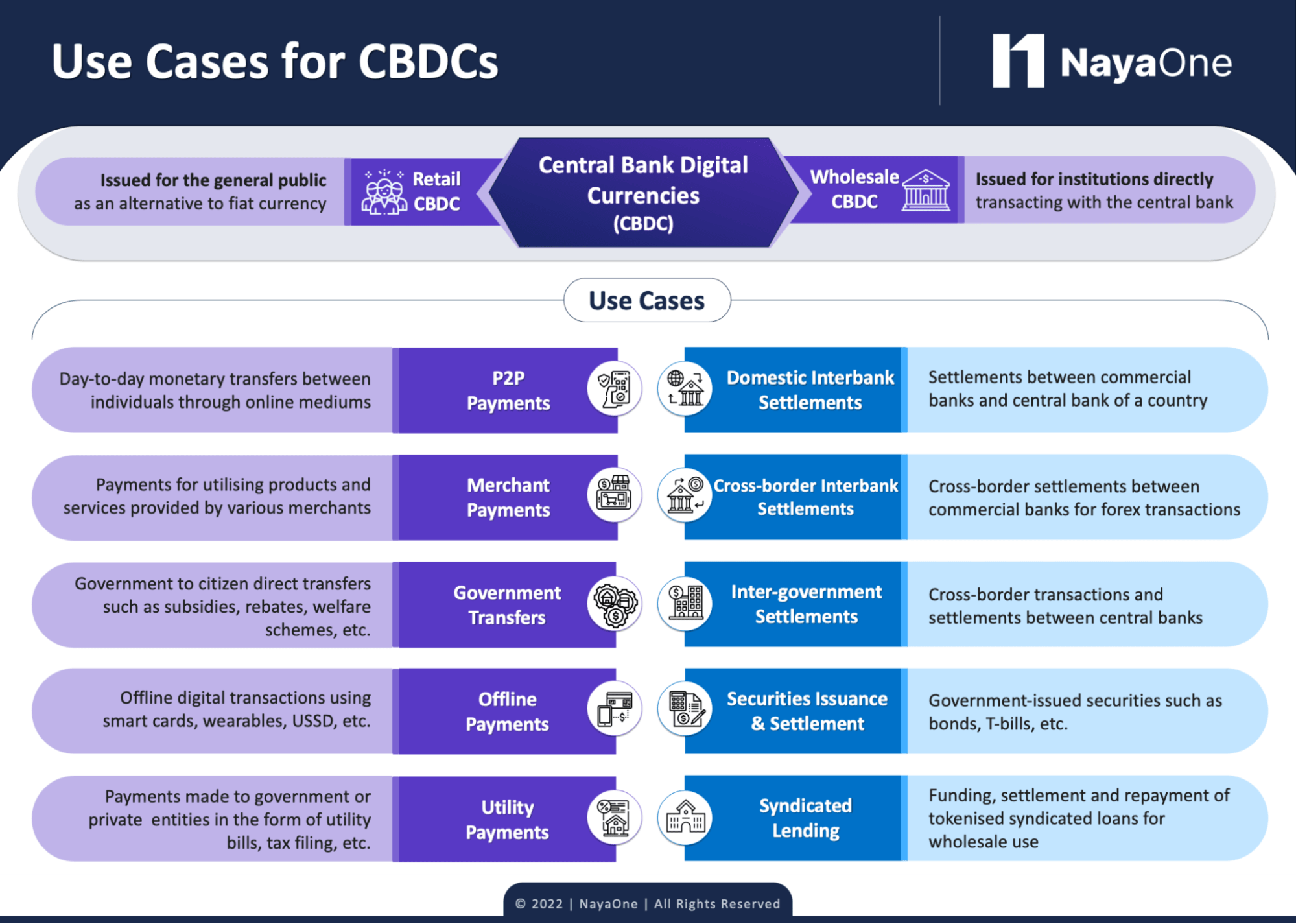

CBDC Use Cases: Retail and Wholesale

Just like fiat money (or M0 money supply—central banks’ technical speak for the most liquid form of money, i.e. cash), CBDCs can serve in retail as well as wholesale (or commercial) settings.

The purpose of CBDCs is the innovative use of technology to enable fast and secure transactions, maintain records efficiently, and increase the overall efficiency of the financial system.

Retail CBDC Use Cases

Just like fiat money (or M0 money supply—central banks’ technical speak for the most liquid form of money, i.e. cash), CBDCs can serve in retail as well as wholesale (or commercial) settings.

- Individuals (P2P),

- An individual and merchants for financing products and services (P2M), or

- Businesses (B2B)

CBDCs offer reduced friction in the clearing and settlement of retail transactions, either online or offline.

Retail CBDC Examples Around the World

China’s digital yuan (e-CNY), by the People’s Bank of China, successfully managed to garner sizeable utility.

It was due to its wide availability and government promotions. 261 million users (almost one-fifth of the country’s population) had digital yuan wallets as of January 2022.

Nigeria’s eNaira also set a transformative example of how retail CBDCs financial inclusion and public welfare. One of its use cases is enabling middlemen-free government aid transfers to those in need.

Households, businesses, and the Nigerian diaspora can also make secure payments without yielding interest amongst peers and financial institutions.

Wholesale CBDC Use Cases

Wholesale CBDC use cases focus on settlements, both domestic and cross-border, between central banks and commercial financial institutions that hold reserves at the central banks.

At this level, CBDCs can strengthen the risk management associated with transactions. They can also resolve concerns surrounding counterparty credit and liquidity.

Wholesale CBDC Examples Around the World

Banque de France ran an experiment for interbank settlements using CBDC. It consisted of the testing of an end-to-end transaction lifecycle of a digital bond, from issuance, subscription, and eventually, coupon payment.

Another notable example is the mCBDC Bridge, a co-creation project involving the BIS Innovation Hub Hong Kong Centre, the Hong Kong Monetary Authority, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China, and the Central Bank of the United Arab Emirates.

It emphasised a wholesale CBDC that supports multi-currency cross-border payments. Realising the complexity of the many networks and arrangements of large global banks, the project developed a prototype platform (the mBridge) that can address the limitations of existing systems by delivering real-time international settlements using distributed ledger technology (DLT).

CBDCs Are Here to Stay

CBDCs are set to the payments landscape with their promising potential. The research, development, and experimentation of central bank technologies are paving the way for innovation in financial services.

This aligns perfectly with our mission at NayaOne — to help financial institutions build better products and services.

We provide a platform for experimentation, development, and launch of various financial technologies, such as CBDCs. From multiple CBCD use case testing involving third-party collaboration to simulations to analyse performance and usability, the NayaOne digital transformation platform can be a powerful catalyst for innovative CBDC projects.