Jonathan Middleton

Director, Financial Services

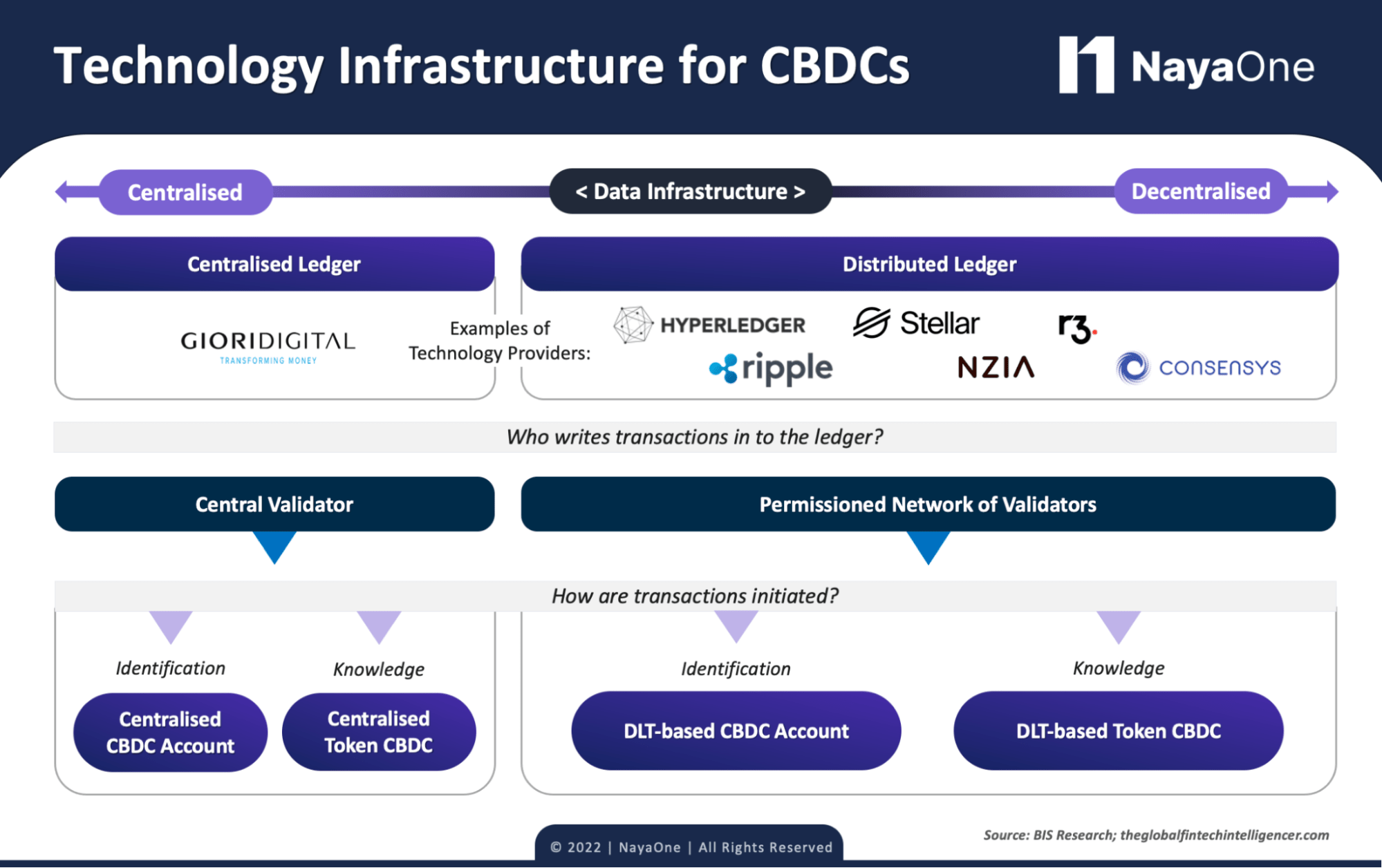

Technology forms the backbone of any digital operation as we know it and CBDC tech is no different. Similar to their not-so-distant counterparts—cryptocurrencies, CBDCs run on digital ledgers, which act as effective record-keeping mechanisms.

The data infrastructure can range from being centralised to decentralised depending on the level of control that central banks want to keep on validation and record maintenance of transactions. In a centralised infrastructure model, the authority to update the database rests with a central validator. China’s digital Yuan (e-CNY) and Uruguay’s e-Peso are examples of models that employ centralised infrastructure for their digital currencies.

Decentralised infrastructures, on the contrary, operate on distributed ledger technology (DLT) akin to the blockchain networks used for cryptocurrencies like Bitcoin and Ether. An important distinction here is that DLT-based CBDCs operate on private, permissioned networks that are controlled by the central bank. Only permissioned validators are allowed to record transactions on the digital ledger.

Ripple Effects of CBDC Tech Infrastructure

Decision on data infrastructure directly impacts the efficiency and utility of the digital currency as well. Centralised infrastructures provide the benefit of faster transaction times, which can be a concern for decentralised infrastructures due to their complex validation mechanisms. An account versus token-based approach is also something that leads to different mechanisms of record-keeping and utility to be factored in when deciding on the technology infrastructure. All said and done, the jury is still out for what works best and what doesn’t as global central banks continue their exploration projects.

CBDC Tech is a Tough Nut to Crack

Following initial research, it’s the process of continuous development and testing phases to figure out what works best and fits the expected outcome goals. That’s where we come in — the NayaOne platform is built for complex financial technology projects that aren’t one-hit-wonders but consistent and iterative efforts towards successful products and services. You’ve got the idea; we’ve got the platform to test and launch. From validating frameworks and technical implementations to testing proof of concepts using synthetic datasets and simulations, NayaOne can be the launchpad for CBDC projects building the future of digital payments.