The financial services industry is on the brink of a profound shift – not because of AI in general, but because of a new generation of AI agents that are set to redefine how banks and vendors operate, build, and compete.

Over the past year, we’ve seen the hype around generative AI settle into something more substantial: execution. AI is no longer just a powerful writing or summarizing tool. It’s becoming a workforce – intelligent, autonomous, and rapidly evolving.

We’re witnessing the rise of AI-first organisations, where agents aren’t just assistants, they’re builders, analysts, and decision-makers. And it’s already starting to reshape the finance sector.

The Shift Already Underway in Finance

Banking is ripe for AI agent disruption. It’s an industry driven by data, compliance, workflow-heavy processes, and customer expectations for speed and personalisation.

From underwriting to transaction monitoring, fraud detection to customer onboarding, AI agents can do more than assist – they can take action. The question is not if this will change financial services, but how soon.

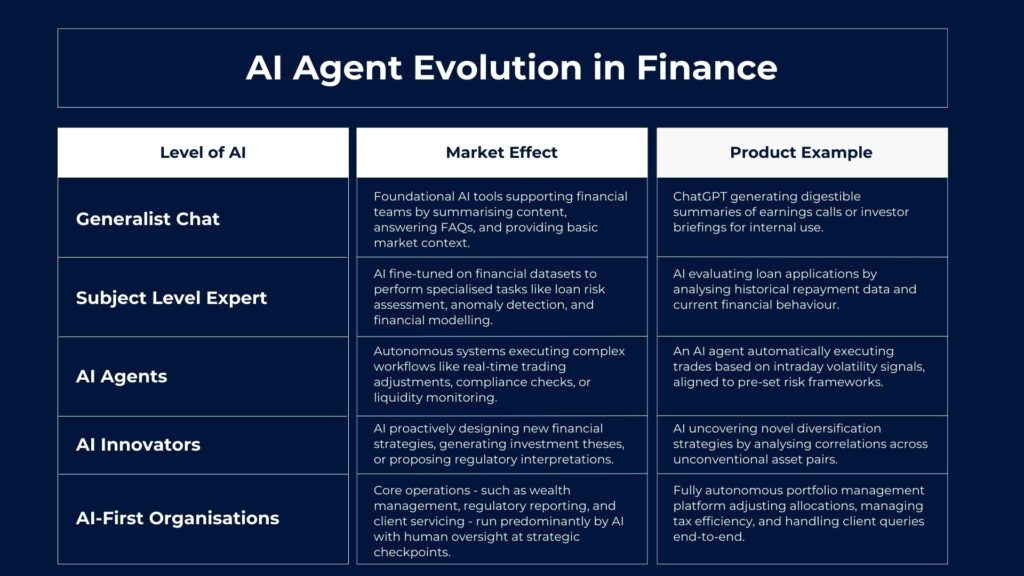

The 5 Levels of AI Agent Evolution

Like any emerging technology, the development of AI agents follows an evolution. Each level brings new capabilities – and new implications for how banks build, staff, and scale.

Level 1: Generalist Chat

This is where most banks started. Generalist AI tools like ChatGPT helped automate knowledge retrieval, summarisation, and client communication. For example, HSBC used early chatbots in 2022 for basic customer inquiries, reducing call centre volume by 15%.

These tools were co-pilots – dependent on human input, without deep understanding of the financial domain. While useful, they showed clear limits in regulated, context-heavy environments due to lack of specificity and compliance alignment.

Level 2: Subject-Matter Experts

Banks began integrating AI models trained on financial-specific data – compliance, legal, risk, and ESG. For instance, JPMorgan’s COiN platform, launched in 2017 and enhanced by 2023, analyses legal documents with domain-specific accuracy. These smarter co-pilots didn’t just respond but understood context. Vendors building vertical AI platforms, like Finastra’s Fusion AI, started to outperform horizontal tools, offering precise solutions for insurance underwriting or credit risk scoring tailored to financial workflows.

Level 3: Agents (We Are Here)

This is the tipping point.

AI is moving from co-pilot to autopilot. Agents are executing tasks autonomously: reviewing transactions for AML, flagging exceptions in underwriting, managing email queues, and completing KYC workflows.

For example, Standard Chartered’s 2024 AI pilot for AML reduced transaction review times by 35%. The value shifts from what AI can suggest to what it can do. Banks embracing this shift see exponential efficiency gains, while those lagging risk being outpaced by leaner, AI-driven vendors.

Level 4: AI Agent Innovators

By the late 2020s, AI agents will likely optimise processes by identifying bottlenecks, rerouting workflows, and proposing new strategies based on customer behavior and real-time feedback.

Imagine an AI that not only manages loan origination but suggests process improvements, like ING’s 2025 pilot that reduced mortgage approval times by rerouting data flows. This shift from cost saver to growth engine requires trust in agent performance, auditability, and explainability – non-negotiables in a regulated environment.

Level 5: AI-First Organisations

By the early 2030s, AI-first organizations will run on networks of intelligent agents managing treasury, customer support, and real-time risk, guided by strategic human operators. Early signs are visible: Renaissance Technologies’ AI-driven hedge funds execute autonomous trading, and Kabbage’s automated SMB lending scaled loan approvals by 50% in 2024. Fraud engines, like those from Feedzai, retrain in real time to detect novel threats. Full-service AI-first banks are emerging but face significant regulatory and cultural hurdles before widespread adoption.

Challenges To AI Agent Adoption

Scaling AI agents in banking is not without obstacles. Key challenges include:

- Regulatory Compliance: Regulations like GDPR, DORA, and the EU AI Act demand robust explainability and data privacy, complicating agent deployment. For example, GDPR fines for non-compliant AI reached €1.7 billion in 2024.

- Data Quality and Integration: Legacy systems and siloed data hinder AI performance. A 2024 Accenture report noted 60% of banks struggle with data integration for AI.

- Model Bias and Trust: Ensuring unbiased outputs and building trust in autonomous decisions is critical, as seen in early 2024 backlash against biased credit scoring models.

- Cost and Talent: High costs for cloud migration and a shortage of AI expertise slow adoption, with 70% of banks citing talent gaps in a 2025 Deloitte survey.

Addressing these requires investment in governance frameworks, unified data infrastructure, and controlled testing environments.

Readiness is Everything

The shift is underway, with profound implications for finance. A 2025 Bank of England survey found 75% of financial firms use AI, up from 53% in 2023, with over half involving automated decision-making. Goldman Sachs’ GS AI Assistant, aiding 10,000 employees, automates 95% of IPO prospectus drafting, boosting productivity.

For institutions stuck on co-pilot tools, the window to adapt is narrowing. Ask:

- Which business areas can benefit from intelligent autonomy?

- What technical, cultural, or regulatory barriers must we address?

- Are we building explainability, trust, and control into our AI systems?

Banks face competition not just from peers but from AI-native financial organizations operating faster and leaner. The next generation of leaders will build with agents, not just around them.

Ready to scale AI the right way? Get in contact.