NayaOne’s solution

NayaOne has seen the benefits of the intersection between fintech and incumbents for some time. Founded in 2018 the company has created an innovation infrastructure aimed at speeding up the integration of new technologies.

Providing banks with a single point of access they facilitate the visibility of hundreds of fintechs and datasets through their Digital Sandbox and Fintech-as-a-Service solutions.

NayaOne onboards fintechs into their marketplace, which incumbents can then use to choose the technologies they are interested in working with. The company also provides synthetic datasets, allowing banks to test products within the Sandbox.

The advantage of working with fintechs

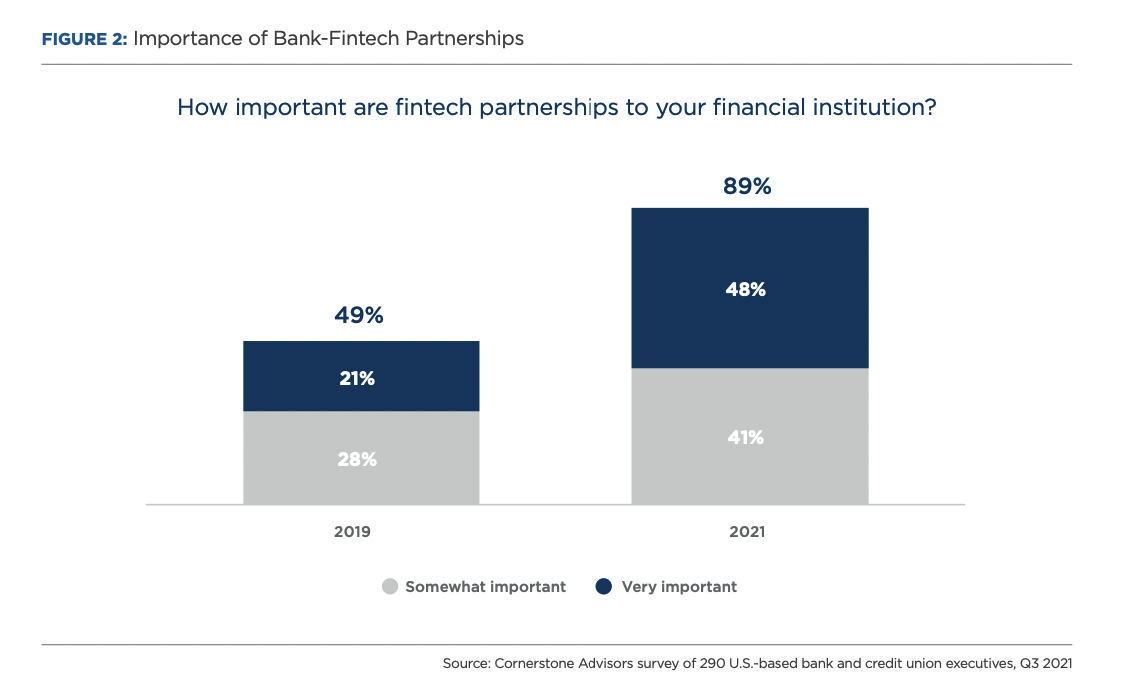

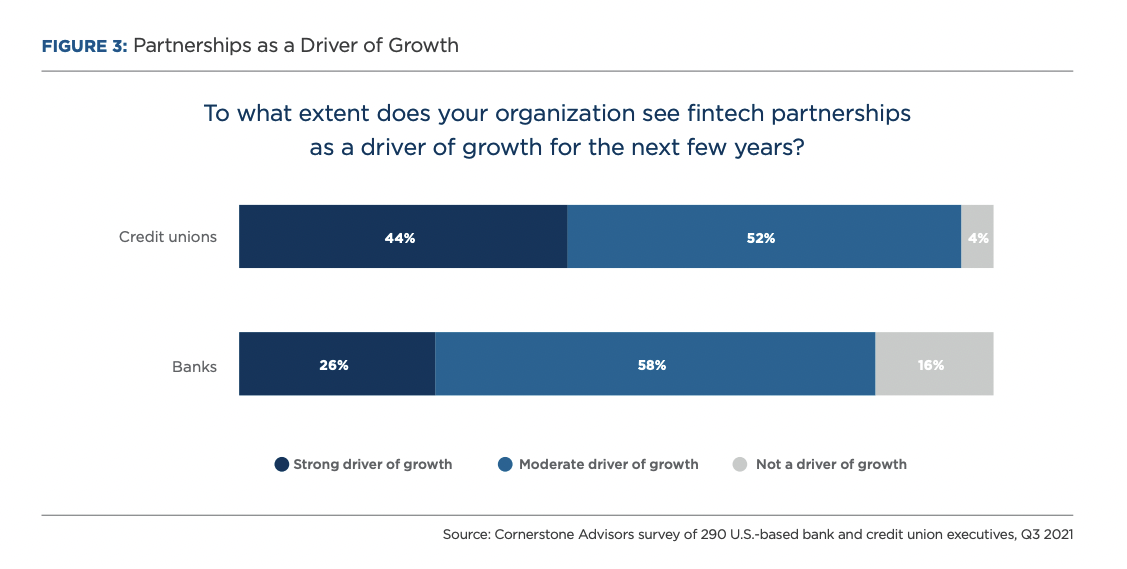

They aren’t the only ones who believe this. According to a report by Cornerstone Advisors, nearly two-thirds of banks and credit unions have entered into at least one fintech partnership. Of those who haven’t, 37% expect to in 2022. The vast majority of them believe these partnerships to be a driver of growth.

Fintechs have changed the shape of financial services. As they become further integrated into consumers’ daily life, digital innovation is becoming the norm.

Despite deep pockets, innovation in the traditional finance giants can be slow and laced with bureaucracy. Fintechs, which are usually built on specific expertise in a particular field, can speed ahead, gaining a competitive advantage and responding quickly to developments in technology.

The marrying of the two can bring incumbents further forward in their digitalization. Streamlining the collaborative process of the two sectors could make all the difference to banks’ competitive advantage.

NayaOne’s partnership with Lloyds