Varun Resh

Fintech & Emerging Technologies

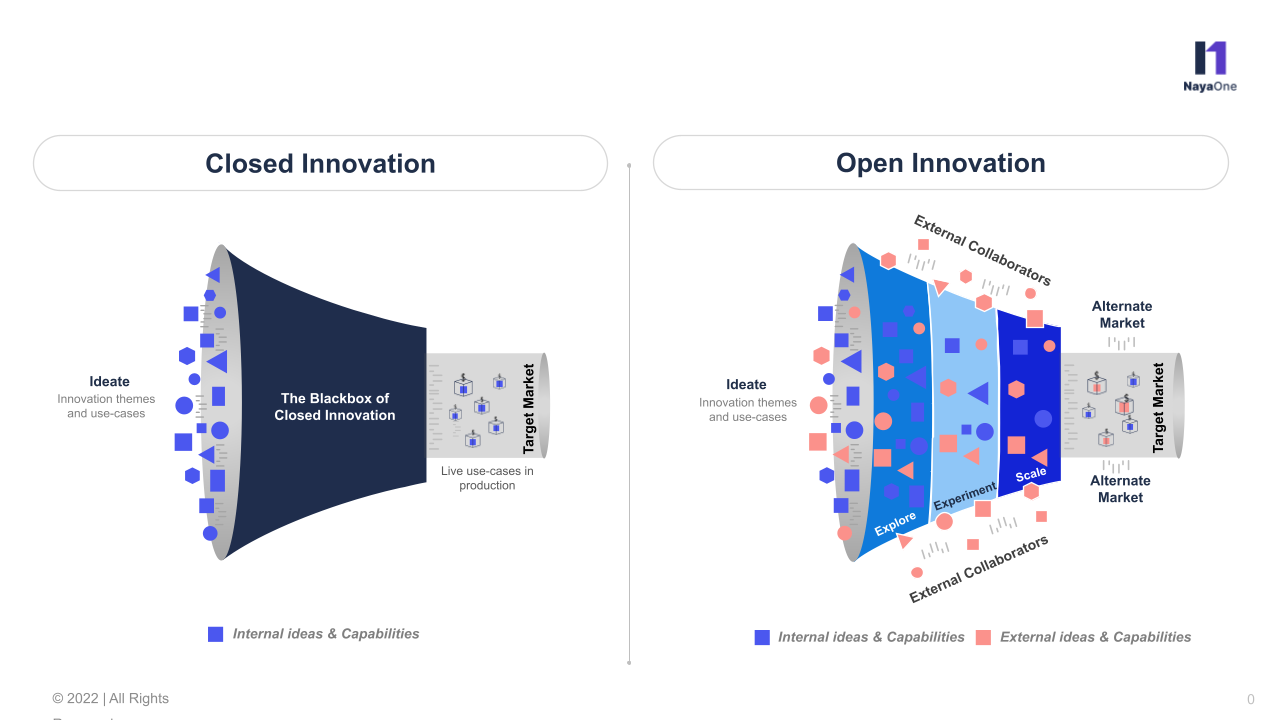

In the age of hyper-competition, disruptive innovation is a linchpin for growth, and the financial industry is no exception to this rule. Until a few years ago, financial institutions relied on a closed innovation model that leveraged in-house research and development teams and internal technology infrastructure to launch new products and services; but the entry of FinTechs combined with new technologies, stringent regulations, and market forces have changed the way banks look at innovation. Underpinned by co-creation, the concept of open innovation has led to strategic and tactical alliances in the financial sector to unlock value for the business, innovation partners, and customers.

What is Open Innovation?

It is an ecosystem in which two or more companies collaborate through a digital platform to co-ideate, co-create, and co-commercialise ideas by pooling in their technological capabilities and market resources.

This ecosystem enables financial institutions to combine internal and external ideas and capabilities into organisational systems and be a part of the innovation process with third parties instead of working in silos and depending only on internal resources and knowledge. It also allows financial institutions to experiment with new solutions that can be launched in alternate markets in partnership with other institutions or by bringing custom products suitable for the niche market’s requirements.

Why Open Innovation?

Its adoption in banking is driven largely by the shift to an information-based, digital economy; the 2008 financial crisis, automation, growth of FinTechs, and the data deluge from digital-first operations have further intensified this shift. According to McKinsey, 55% of US consumers use FinTech solutions, while 20% in the UK have an account with a digital bank. As customer behaviour continues to change rapidly, traditional banks need FinTechs and their technical expertise to co-innovate if they want to grab and retain consumer mindshare. FinTechs need the experience and data that banks possess. This approach helps in exporting and importing ideas between the two groups in addition to refreshing and exchanging existing knowledge. The partnerships often include an extended network of innovation labs, clients, suppliers, consultants, regulators, and platform providers. It also offers banks skin in the game in a transforming landscape and the opportunity to lead the change by embracing the era of shared risk and rewards.

This phenomenon has been driven by several undercurrents that have resulted in ‘Openness’ at various levels of the financial services industry:

- Open Banking: Open Banking has become a global phenomenon. Both regulators and markets have been driving the trend which warrants financial institutions to share data with third-party providers and allow them access to interbank payment rails to initiate payment transactions by procuring customers’ consent.

- Open Architecture: The Open Architecture model offers best-of-breed products to meet customers’ needs in the best way possible, including proprietary as well as external products and services to clients.

- Open Platforms: The platformification of banking has unlocked the potential to create marketplaces and super-app propositions for customers. It involves intertwining financial and lifestyle products and building embedded finance propositions for customers to allow seamless, personalised, and contextual access to financial products.

- Open APIs: Open and interoperable APIs are at the core of Open Banking and Open Finance, allowing third-party innovators to access banking data and capabilities in a standardised and scalable manner.

- Open Business Models: New-age business models, such as banking-as-a-service, banking marketplace, super-apps, and embedded finance, require collaboration with outside-the-firm innovators to orchestrate new operating models and business models.

It is imperative to gain the speed-to-market advantage in a crowded landscape by accelerating the time-to-market for products and services. This concept brings together diverse skill sets, technologies, and capabilities to speed up innovation. It allows banks to focus on their core competencies while reducing costs, increasing productivity and profitability, and improving efficiency.

Implementing Open Innovation

To implement this concept successfully, banks should make it a philosophy and core strategy and ensure that the three main facets of open innovation — outside-in, inside-out, and coupled processes — are fully integrated. With outside-in, ideas from acquisitions, intermediaries, clients, FinTechs, and non-financial companies flow into the organisation to build new products, services, and business models. From the inside out, there’s an outflow of ideas that are not used internally to partners who can leverage them more effectively. Coupled processes combine knowledge from within and outside the organisation to develop new ideas and commercialise them.

Innovation openness allows banks to white-label the solutions built by partners within the network. By rebranding and selling such products and services, banks can generate value for their clients and not worry about being left behind. For example, in 2017, Deutsche Bank’s asset management arm, Deutsche AM, launched a robo-technology solution called WISE. WISE is a flexible solution that can be customised to suit the requirements of diverse Financial Institutions (FIs). It allows companies to integrate their digital portfolio management at reduced costs. Many FIs have integrated Deutsche AM’s capabilities with their own, white-labelling the solution and promoting it as an offering.

Another way for banks to adopt this concept effectively is to share the vast volumes of customer data in their possession with partners. This concept is a subset of the overall concept called open banking.

Open banking Application Programming Interfaces (APIs) have recently seen an uptake following sweeping regulatory changes across the globe. In the European Union, the UK, Australia, and some Asian countries, large banks have been mandated to share their customer data to drive innovation and competition. In the UK, within the first six months of 2020, due to the pandemic, users of open banking-led applications nearly doubled and continue to grow. Among the UK’s open banking licence holders, 30% are infrastructure providers, and 70% operate in customer experience. Experts believe that open banking, though at a nascent stage, could shape the future of banking, considering the many use cases.

Payment processor Stripe, for instance, has launched an API called Stripe Treasury in collaboration with Goldman Sachs, Barclays, and Citibank. Through this API, Stripe’s customers can offer banking-as-a-service to their end customers. Retail giant Amazon has partnered with banks to provide point-of-sale loans to customers to enhance the buying experience.

Future of Innovation: From Close to Open

This novel innovation concept creates a boundaryless and agile organisation while providing an environment of continuous learning and development. It shortens decision cycles and leads to hyper-growth. It also lays the foundation for elevating the customer experience. With this innovative concept, banks can script their own success story in a competitive marketplace.

NayaOne is built for open innovations. It’s the essence of what we do as a platform that enables ecosystem stakeholders — banks, regulators, technology vendors, and FinTech startups — to co-create and collaborate on new-age projects.